Crafting a Balance Sheet in Excel: Easy Guide

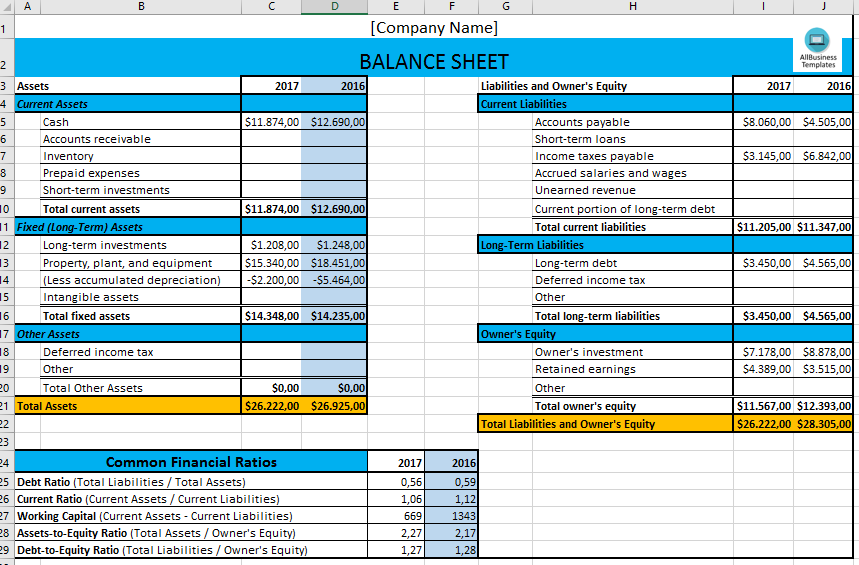

Balance sheets are not just for big corporations; they're equally essential for small businesses, freelancers, and even personal finance tracking. Here, we'll explore how to create a balance sheet in Microsoft Excel, making it simple enough for anyone to understand and implement. Whether you're looking to gauge your company's financial health or just manage your personal assets, an Excel balance sheet can provide you with clear insights.

Why Use Excel for a Balance Sheet?

Excel offers an easy, accessible, and customizable platform for creating financial documents. Here are some reasons why:

- Flexibility: You can tailor the layout to fit your specific needs.

- Calculations: Automatic formulas reduce manual calculation errors.

- Accessibility: Most people have Excel, making it universally accessible for sharing and collaboration.

- Data Analysis: With features like pivot tables, you can perform detailed financial analysis.

Steps to Create a Balance Sheet in Excel

Setting Up Your Worksheet

- Open Microsoft Excel and start with a blank worksheet.

- Name the sheet by clicking on the tab at the bottom and renaming it to something like "Balance Sheet."

- Set up your headers at the top. For instance:

Column A Column B Column C Assets Current Assets Amount

Adding Your Financial Data

- Assets: Begin by listing your assets. These are broken down into:

- Current Assets - cash, accounts receivable, inventory, etc.

- Non-Current Assets - property, plant, equipment, long-term investments, etc.

- Liabilities: Next, list your liabilities in two categories:

- Current Liabilities - accounts payable, short-term loans, etc.

- Non-Current Liabilities - long-term debt, deferred taxes, etc.

- Equity: This includes owner's equity, retained earnings, and common stock if applicable.

💡 Note: Make sure your entries are accurate and up-to-date to reflect the true financial health of your business or personal finances.

Using Formulas for Calculations

- Total your assets, liabilities, and equity using Excel formulas. For example:

- To sum all current assets, type `=SUM(B2:B10)` where B2 to B10 are your asset entries.

- Use `=C2+C3-C4` for total equity if C2 is assets, C3 is liabilities, and C4 is prior period adjustments, if any.

Formatting for Clarity

- Apply formatting to make your balance sheet easy to read:

- Use bold and italic for emphasis.

- Utilize different font colors to distinguish between categories.

- Set borders and fill colors for columns or rows to enhance structure.

Creating a balance sheet in Excel is an invaluable skill for managing finances effectively. With this guide, even those new to Excel can craft a balance sheet that not only tracks their financials but also helps in making informed decisions. The key is to ensure data accuracy, use Excel’s automation features, and maintain a clean, organized layout for clarity. Remember, the balance sheet should reflect the snapshot of your financial situation at a given moment, offering insights into your liquidity, solvency, and how well your business or personal finances are structured. Now that you know how to create a balance sheet in Excel, you can start implementing this knowledge to keep a keen eye on your financial health, or better yet, share it with others for collaborative financial management.

What is the difference between assets, liabilities, and equity?

+

Assets are what you own, liabilities are what you owe, and equity is the residual interest in the assets after deducting liabilities, representing ownership interest.

How often should I update my balance sheet?

+

For most businesses, updating the balance sheet at the end of each accounting period (monthly, quarterly, or annually) is advisable, but small businesses or individuals might opt for more frequent updates to maintain current financial oversight.

Can Excel handle all types of balance sheet formats?

+

Yes, Excel’s flexibility allows you to customize the format of your balance sheet to meet any requirements or preferences, including vertical, horizontal, or comparative formats.

Do I need any special skills to create a balance sheet in Excel?

+

Basic Excel skills like entering data, using formulas, and basic formatting are sufficient. Knowledge of accounting principles, however, can enhance the accuracy and utility of the balance sheet.

How can I verify if my balance sheet is correct?

+

Ensure that Assets = Liabilities + Equity. If this basic accounting equation holds true, your balance sheet is balanced. You can also compare figures with previous periods or consult with an accountant for an audit.