5 Essential Tips: How Long to Keep SSDI Papers

Retaining documentation related to your Social Security Disability Insurance (SSDI) is vital for maintaining your benefits and managing your affairs effectively. Given the complexity and the ongoing nature of SSDI claims and benefits, understanding how long to keep SSDI papers becomes critical. This blog will explore the reasons behind this need for retention, the specific documents to keep, how to organize them, and tips for digital management. Here are five essential tips on managing your SSDI documentation:

Why Keep SSDI Papers?

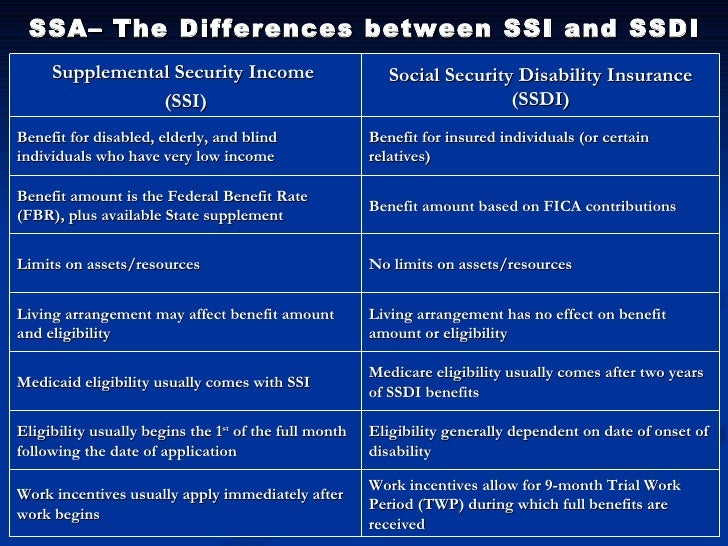

SSDI-related documents hold significant importance for several reasons:

- Proof of Disability: Documents like medical records and decisions from the Social Security Administration (SSA) are essential for proving your continued eligibility for benefits.

- Benefit Adjustments: If your benefits are adjusted, you’ll need past records to contest any errors or discrepancies.

- Tax Filing: Benefits might be taxable, requiring documentation during tax season.

- Appeals: If you need to appeal a decision or dispute a denied claim, having all relevant paperwork can significantly bolster your case.

- Legal Protection: Keeping records protects you legally, providing evidence of your eligibility and any payments made or received.

Documents to Keep

The following documents should be kept:

| Document | Purpose |

|---|---|

| SSDI Award Letter | To prove initial entitlement to benefits |

| Disability Determination Decision | Explanation of your disability and eligibility determination |

| Medical Records | To verify your ongoing disability status |

| Pay Stubs or Earnings Statements | To demonstrate income levels and work history |

| Correspondence from SSA | Any communication regarding changes to your case or benefits |

| Tax Documents | Needed for filing taxes and managing potential tax liability |

| Representative Payee Records | If you have a representative managing your benefits, keep records of their transactions |

| Bank Statements | To track SSDI payments and report them for tax purposes |

| Insurance Documents | Documents showing coverage for medical treatments related to your disability |

💡 Note: Keep both hard copies and digital copies of these documents for redundancy.

How Long to Keep SSDI Papers?

Here’s a breakdown of the recommended retention periods:

- Indefinitely: Keep your initial award letter, disability determination decision, and any documents related to appeals or reviews.

- At Least 7 Years: Tax documents and correspondence from SSA should be kept for seven years as per IRS guidelines.

- 5 Years: Financial records like bank statements and pay stubs might be retained for five years, as they relate to benefits received.

- 2-3 Years: Medical records proving ongoing treatment might be kept for 2-3 years after treatment concludes, although keeping them longer can be beneficial.

Organizing Your Documents

Organizing SSDI papers in an effective manner ensures quick access when needed:

- File Folders: Use categorized folders labeled by document type and date.

- Digital Management: Scan documents and use a cloud storage solution like Google Drive or Dropbox. Use descriptive names and organize by folders.

- Backups: Regularly back up digital files to avoid data loss.

- Physical Safety: Store hard copies in a safe place, such as a lockbox or fireproof safe.

Electronic Management of SSDI Papers

With the digital age, managing your SSDI papers electronically offers several advantages:

- Cloud Storage: Access documents from anywhere with an internet connection.

- Security: Use password-protected accounts and enable two-factor authentication.

- Searchability: Utilize tagging, naming conventions, and search features for efficient document retrieval.

- Paperless Approach: Reduce clutter by moving towards a paperless system, scanning, and destroying original documents after ensuring digital copies are secure.

In summary, keeping SSDI documentation is not just about complying with legal requirements; it's about having the evidence to support your claim, manage your benefits, and ensure continuity in case of any SSA inquiries or audits. Here are the key takeaways:

- Retain critical documents like award letters and disability determination decisions indefinitely.

- Organize documents systematically, both in physical and digital formats.

- Securely manage digital files with cloud storage and backups.

- Retain tax-related documents for at least seven years.

By adhering to these tips, you'll ensure that you have all the necessary documentation for seamless management of your SSDI benefits, ready for any eventuality or review process.

What if I lose an important SSDI document?

+

If you lose an important document, contact the SSA office immediately. They can reissue documents, but delays might occur. Keep duplicates or store important documents securely to prevent loss.

Is it safe to keep digital copies of SSDI documents?

+

Yes, provided you use secure, password-protected cloud storage solutions and ensure regular backups. However, it’s wise to also keep physical copies as a backup.

Can I shred old SSDI documents?

+

Before shredding, ensure that the document has been digitally preserved or can be retrieved from the SSA if necessary. If not needed, shredding sensitive documents is recommended for security.