7 Tips on How Long to Keep Paperwork Records

Understanding Record Retention

The lifeblood of any business or individual in managing their financial affairs effectively is the practice of record retention. Keeping paperwork records for the right duration not only ensures legal compliance but also provides a safety net during audits or disputes. Here, we will delve into seven vital tips on how long you should keep various types of paperwork records to balance both practicality and necessity.

1. Tax Documents

The Internal Revenue Service (IRS) mandates taxpayers to keep tax-related documents for:

- Federal Tax Returns: Keep for at least 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later.

- Employment Tax Records: Retain for at least 4 years after the tax due date or payment date.

- Business Records: Retain indefinitely, especially if they support information on tax returns not yet filed or are related to depreciable property.

📚 Note: Always retain records longer if there are outstanding tax issues or potential disputes with tax authorities.

2. Financial Statements and Bank Records

Financial statements and bank records serve as important proof of financial transactions and are crucial for:

- Bank Statements: Keep for 7 years, especially for business accounts to match tax records.

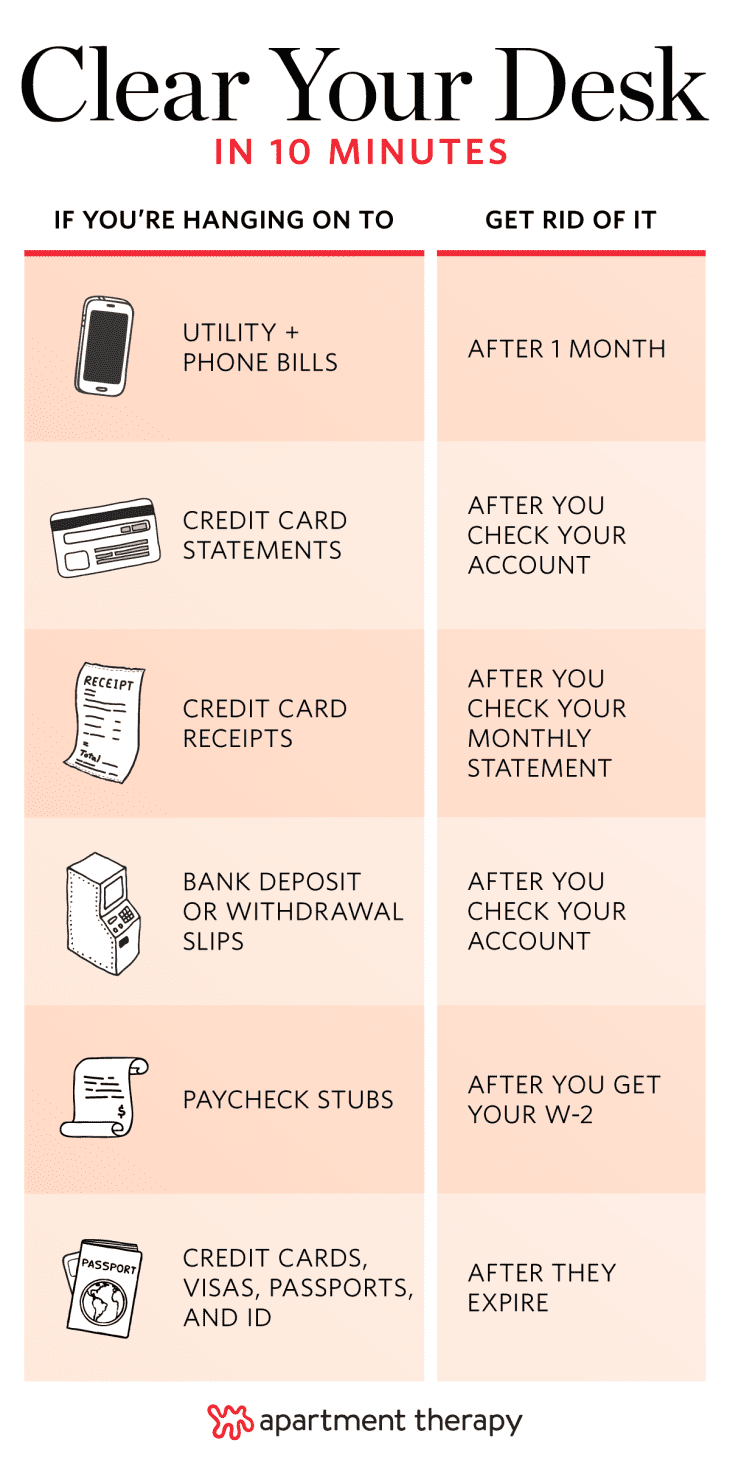

- Credit Card Statements: Keep until reconciled, generally 1-3 years.

- Monthly/Quarterly Statements: Keep for at least 7 years to cross-reference with tax returns and annual financial reports.

💡 Note: Regularly shred statements to prevent identity theft, retaining digital or verified copies for archival purposes.

3. Employee and HR Records

Maintaining accurate employee records is critical for various legal, administrative, and compliance purposes:

- Payroll Records: Keep for at least 3 years after the date of last payment.

- Employment Applications: Retain for at least 1 year.

- Health and Safety Records: Keep indefinitely, especially concerning workplace accidents or injury records.

4. Legal Documents and Contracts

Contracts, leases, and other legal documents require careful consideration:

- Contracts: Retain until the contract has been fully discharged or the statute of limitations has run out.

- Leases: Keep until the lease term ends plus any extensions or obligations post-termination.

- Legal Correspondence: Retain for 7 years or as advised by legal counsel.

5. Insurance Documents

Insurance documents are a critical aspect of protecting assets and liabilities:

- Homeowners Insurance: Keep indefinitely, particularly in areas prone to natural disasters or claims.

- Auto Insurance: Retain for as long as you own the vehicle or until all claims are settled.

- Health Insurance: Keep records for at least 3 years after the policy terminates.

6. Retirement and Investment Records

Investment and retirement planning documents require long-term attention:

- Retirement Plan Statements: Keep for at least 7 years after you’ve accessed your account or retirement.

- Stock Certificates: Retain until after the stock is sold or you dissolve your holding.

- Dividends and Distributions: Keep indefinitely for capital gains reporting and tax purposes.

7. Medical Records

Healthcare records are personal and sensitive, requiring careful management:

- Bills: Keep for 5-7 years due to insurance claims and tax deductions.

- Vaccination Records: Keep indefinitely as they could be pertinent for legal and health reasons.

- Lab Results: Retain these records for at least 10 years or as long as state law requires.

In summing up, the retention period for paperwork records varies based on the type of document and the applicable laws. Here are key points to remember:

- Understand local, state, and federal laws regarding record retention.

- Balance legal requirements with practical space limitations.

- Shred sensitive documents appropriately to prevent identity theft.

- Consider digitizing records to save space and for ease of access and backup.

Why is it important to keep records for tax purposes?

+

Keeping tax records allows you to substantiate your income and deductions in case of an audit by tax authorities. Additionally, it helps in tracking financial transactions and providing proof in case of disputes or legal issues.

Can I keep my records electronically?

+

Yes, electronic records are generally accepted by tax authorities. Ensure they are backed up, secure, and easily retrievable. Some documents may still require paper copies, so check with relevant regulations.

What should I do with records after the retention period ends?

+

Once the retention period has ended, documents containing sensitive information should be shredded to prevent identity theft. Non-sensitive documents can be recycled or discarded appropriately.