Chapter 13 Paperwork: How Long Should You Keep It?

Managing personal and business documents effectively can be a daunting task, especially when deciding how long each type of document should be kept. This guide will help you navigate the complex waters of record retention to ensure compliance, reduce clutter, and protect important information.

Why Keep Records?

Before delving into how long you should keep specific documents, it's crucial to understand why record retention is important:

- Compliance with Laws: Various laws require that certain records be kept for a specified period.

- Tax Purposes: Proper record keeping can make tax filing smoother and help in audits.

- Legal Issues: Retaining documents might be necessary for legal proceedings.

- Business Continuity: Historical records can provide insights for future business decisions.

Common Documents and How Long to Keep Them

Financial Documents

Financial documents are critical for audits, tax preparation, and financial planning:

- Tax Returns: At least 3 years, but it’s often recommended to keep them for 7 years if there’s potential for fraud.

- Bank Statements and Receipts: Keep for 1 year, unless needed for tax purposes.

- Credit Card Statements: Retain for 1 year, or longer if they contain tax-related expenses.

- Investment Records: Indefinitely, or at least 7 years after selling the asset.

- Home Purchase or Sale: Keep for at least 6 years after selling the property.

Business Records

For businesses, retaining the following records is crucial:

| Record Type | Retention Period |

|---|---|

| Articles of Incorporation | Permanently |

| Business Licenses and Permits | Life of Business + 5 Years |

| Contracts | 7 Years After Termination |

| Employee Records | At Least 3 Years After Termination |

📝 Note: Always check federal, state, or local regulations for specific industries which might have unique requirements for record retention.

Personal Documents

While less structured, personal document retention can have significant implications:

- Will: Until it’s superseded or no longer valid.

- Deeds: Indefinitely.

- Insurance Policies: As long as the policy is active.

- Medical Records: At least 7 years after the treatment, but indefinitely for major health issues.

- Marriage License, Divorce Decree: Indefinitely.

- Estate Planning Documents: Indefinitely.

Electronic Records

The digital age brings about considerations for electronic records:

- Ensure backups are taken regularly and stored securely.

- Consider cloud storage solutions with compliance to data protection laws like GDPR or HIPAA.

- Regularly review and purge outdated or unnecessary data.

In the era of digital transformation, managing your electronic records efficiently can save time and space, while ensuring accessibility when needed. Here are some tips:

- Organize: Use a file structure that makes sense for your needs.

- Automate: Utilize software to automatically categorize and archive documents.

- Secure: Implement encryption and access controls to protect sensitive data.

🔒 Note: Compliance with data protection regulations is not only essential for legal reasons but also for ethical handling of personal information.

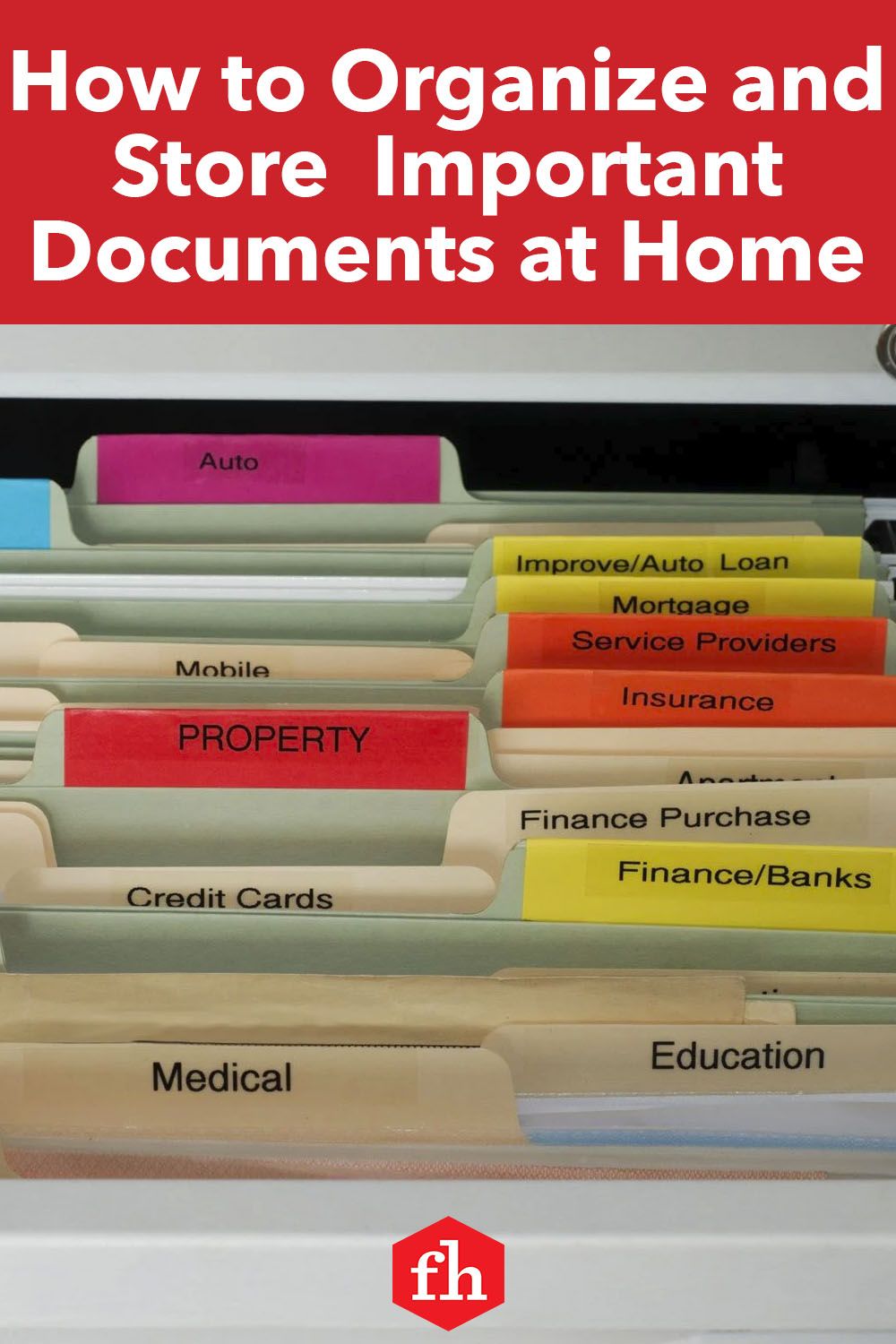

How to Organize Records

An organized approach to record-keeping ensures easy retrieval and protection of documents:

- Physical Records: Use filing cabinets with clear labels, or invest in fireproof safes.

- Digital Records: Employ document management systems that allow for categorization, search, and security.

Pitfalls to Avoid

Common mistakes in document retention can lead to legal issues or unnecessary clutter:

- Not understanding the requirements for retention periods.

- Keeping everything “just in case.”

- Overlooking digital document storage.

Effective record management involves striking a balance between legal compliance and practical efficiency. Over-retention can be as problematic as under-retention:

- Legal Risk: Not keeping required records can lead to fines or legal consequences.

- Space and Management Costs: Excessive records take up physical and digital space, increasing management costs.

- Security Issues: Outdated records can pose security risks if not properly destroyed.

To wrap up, here’s a concise wrap-up on Chapter 13 Paperwork: How Long Should You Keep It?:

- Purpose of Retention: Compliance, tax filing, legal, and business continuity.

- Document Types: Financial, business, personal, and electronic records.

- Retention Periods: Vary significantly by document type, with some documents needing permanent retention.

- Organization and Pitfalls: Effective organization helps in document retrieval and management, avoiding common retention mistakes.

What happens if I don’t keep records for the recommended period?

+

You might face legal repercussions, be unprepared for audits, or find it difficult to manage personal or business affairs effectively.

Can I keep everything digitally?

+

While digital storage is increasingly popular, some documents might need to be retained in their original form, especially for legal reasons.

How can I ensure the privacy of electronic records?

+

Use encryption, secure access protocols, and comply with data protection laws. Regularly audit access logs to monitor for unauthorized access.