How Long Does the IRS Keep Your Paperwork: 5 Facts

The Internal Revenue Service (IRS) is known for its rigorous record-keeping to ensure compliance with tax laws and regulations. Understanding how long the IRS retains your tax records can help you manage your personal records effectively and provide peace of mind knowing that there's a system in place for long-term storage of your financial history. Here are five essential facts about how long the IRS keeps your paperwork:

Fact 1: General Statute of Limitations for Tax Returns

The IRS typically has a three-year statute of limitations to audit or examine a return. This means:

- Ordinary Returns: If you file a standard return, the IRS generally has three years to audit it.

- Form 1040X: If you file an amended return, the IRS still has three years from when the original return was due or filed, whichever is later, to audit your original return.

- Substantial Omissions: However, if you omit more than 25% of your income, the statute extends to six years.

⚠️ Note: The time frame can be extended in cases of fraud, no filing, or criminal activities. Here the IRS has an indefinite period to review and audit returns.

Fact 2: Documentation Retention Period

The IRS keeps paper returns and records for varying periods:

| Document Type | Retention Period |

|---|---|

| Original Paper Returns | 3 years |

| Electronic Returns | Indefinite |

| Supporting Documents | 7 years |

📝 Note: Paper records may be destroyed after three years, but electronic records are retained indefinitely for reference and archival purposes.

Fact 3: Digital Archival Practices

To manage the sheer volume of data, the IRS has shifted to digital archiving:

- Digitized Returns: Tax returns are scanned and digitized, which allows for long-term storage and accessibility.

- Data Archiving: The IRS archives digital data indefinitely, ensuring taxpayers can access their tax records anytime.

Fact 4: IRS Regulations on Audit and Examination

Here’s how the IRS handles audits:

- Audit Process: The IRS can conduct audits within the statute of limitations, but records are often retained for much longer to facilitate any potential future examination.

- Appeals and Collections: If there’s an appeal or collection process, records related to the audit might be kept for a more extended period.

🔍 Note: The IRS has sophisticated systems in place to ensure records are maintained for as long as necessary, considering potential future needs.

Fact 5: Destruction of IRS Records

The IRS has detailed procedures for the destruction of records:

- Paper Records: After the retention period, paper records are destroyed to save space and costs.

- Electronic Data: Digital records, while typically retained indefinitely, might be periodically reviewed for archival purposes or further deletion.

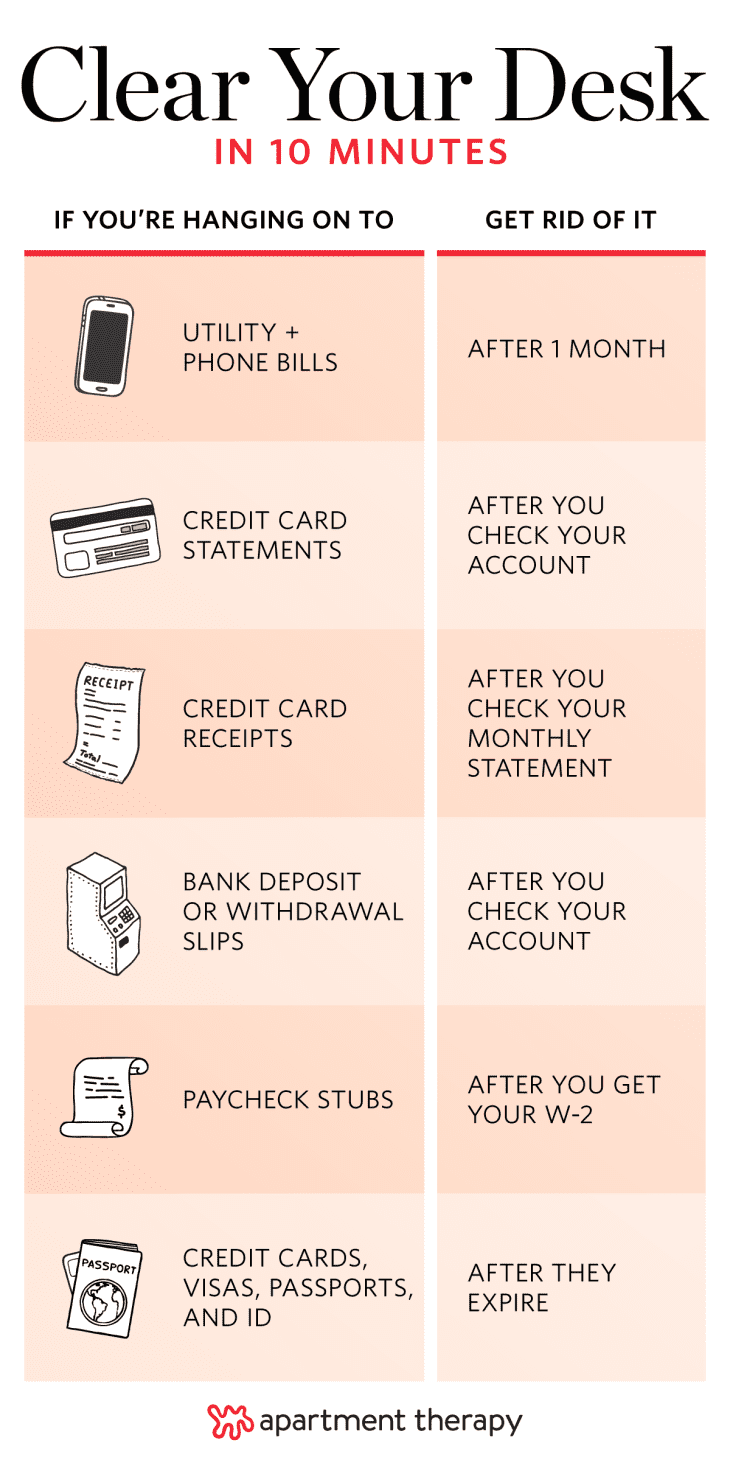

Understanding how long the IRS keeps your tax records sheds light on the significance of maintaining your financial documents. Keeping accurate records for the standard retention periods can ensure that you're covered if questions arise or audits occur. Though the IRS does a commendable job managing records, you should also retain your tax-related paperwork, especially for significant transactions or potential disputes. By staying informed and prepared, you navigate tax season with greater ease.

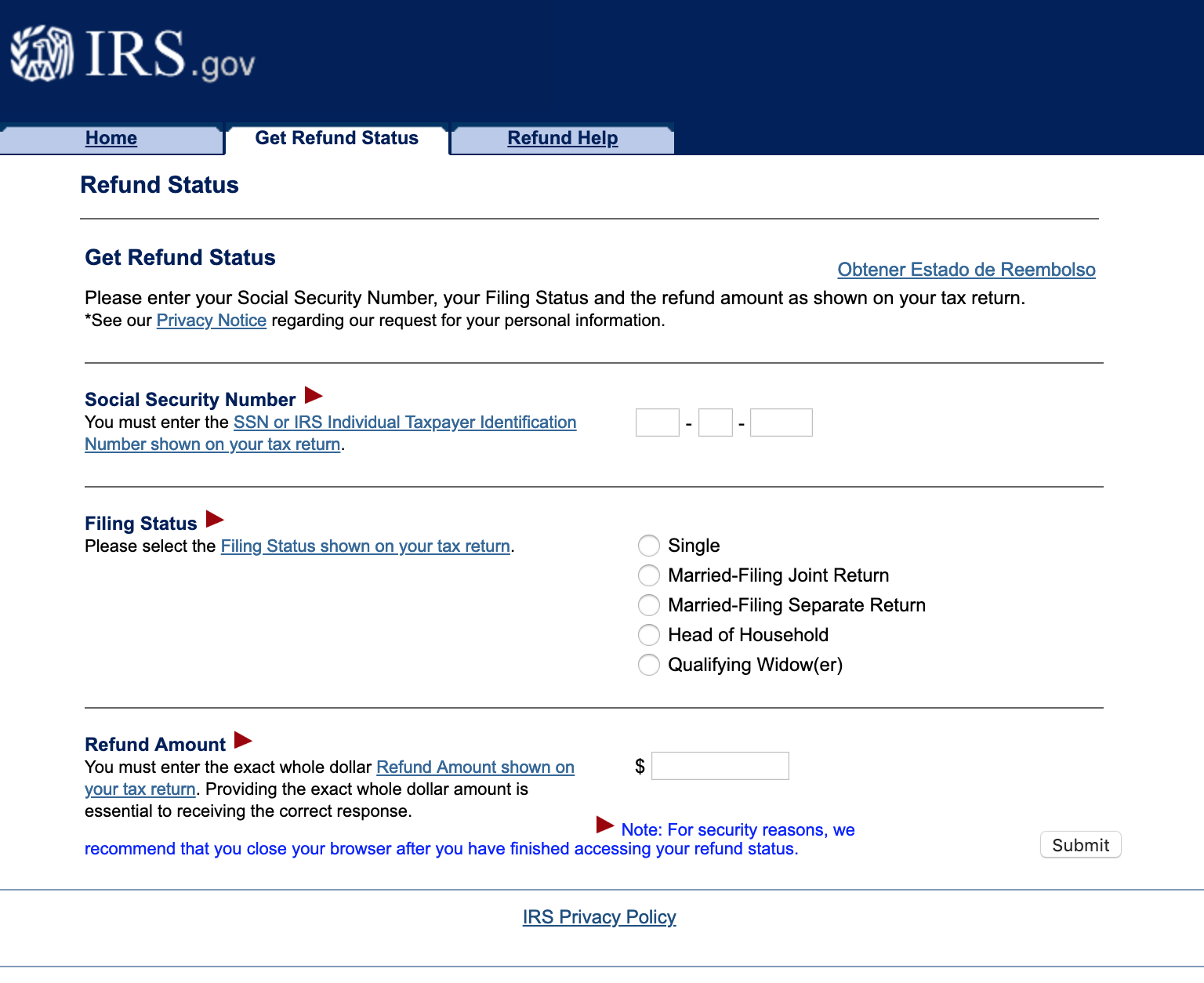

What should I do if I need a copy of my tax return?

+

You can request a tax transcript from the IRS, which includes most of the information from your original tax return. You can do this online via the IRS website or by mail.

Can the IRS audit me after the three-year statute of limitations?

+

Yes, if there’s significant omission of income, fraud, or failure to file, the IRS can audit beyond the three-year period. In such cases, the statute of limitations can extend to six years or indefinitely.

How long should I keep my tax records?

+

It’s advisable to keep your tax records for at least three years from the date you filed your original return or two years from the date you paid the tax, whichever is later. However, keep records longer if there are specific transactions like stock purchases or home improvements.