How Long Does First Premier Keep Delinquent Account Paperwork?

Introduction to First Premier Bank and Its Record-Keeping Practices

First Premier Bank, established in 1919, is a well-known financial institution in the United States that has grown significantly over the years. Its operations include providing various financial products like credit cards, personal loans, and savings accounts. With a commitment to customer service, understanding how First Premier handles delinquent accounts and keeps records is crucial for consumers to manage their financial relationships with the bank effectively.

Understanding Delinquent Accounts

A delinquent account at First Premier Bank arises when:

- A customer fails to make a payment by the due date.

- The account is 30, 60, 90, or more days past due.

- There are repeated missed payments.

This status not only impacts the credit score of the individual but also triggers certain bank policies regarding account management and documentation.

Bank Policies on Record-Keeping

First Premier Bank adheres to standard banking regulations, which outline how financial institutions should retain documents:

- General Banking Records: Must be kept for 6 years.

- Credit Card Transactions: Typically retained for 5 years after account closure.

- Delinquent Accounts: Specifically, documents related to delinquent accounts are retained for an extended period due to potential legal disputes or collection actions.

Delinquent Account Paperwork

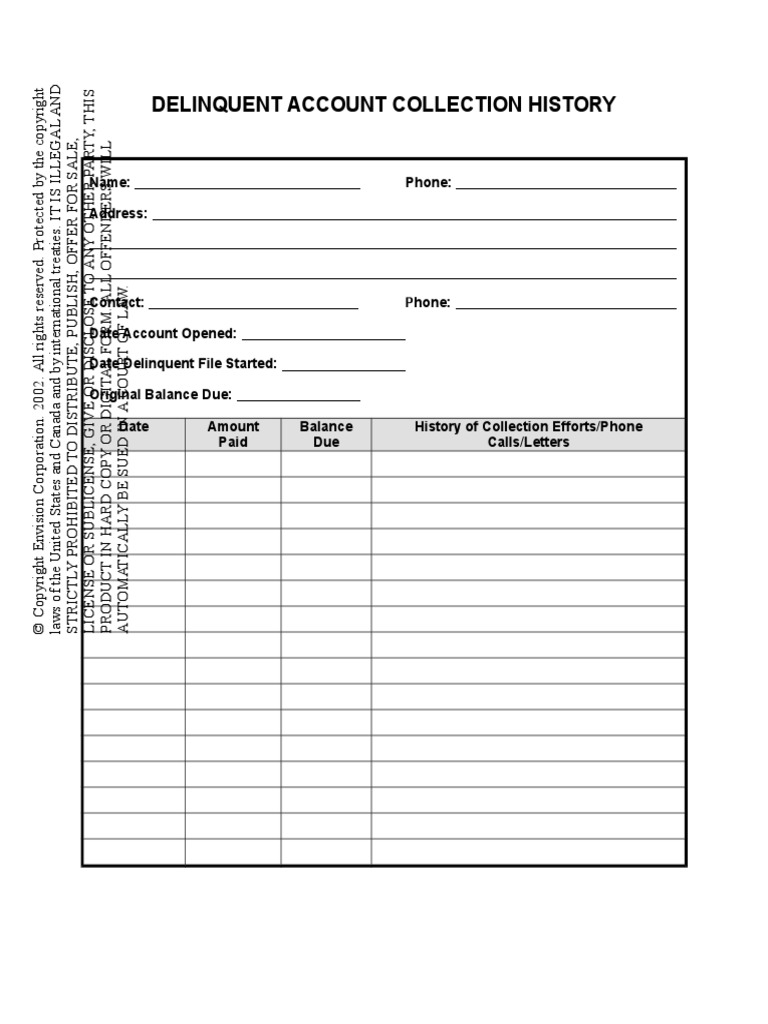

When an account becomes delinquent, First Premier will keep:

- Communication Records: Copies of any written communication, notes from phone calls, and records of any attempted resolutions.

- Payment History: A detailed log of payments made and missed.

- Credit Reports: Periodic credit reports pulled to assess the account’s status.

- Collection Documents: Any action taken by internal or third-party collection agencies, including agreements for payment plans.

How Long First Premier Retains Delinquent Account Paperwork

According to First Premier Bank’s internal policy, paperwork for delinquent accounts can be retained:

- 7 years from the last date of delinquency: This period ensures all legal claims can be addressed, and bank audits can be conducted if necessary.

- If a lawsuit is filed regarding the debt, records will be kept for as long as the litigation is active, extending past the standard 7 years.

💡 Note: Even after the 7-year period, records might be retained in a less detailed form or kept electronically for an extended period.

Legal Implications and Consumer Rights

First Premier must comply with:

- The Fair Credit Reporting Act (FCRA): This law governs how long negative information can be reported on credit reports, but does not dictate how long banks must keep their records.

- The Fair Debt Collection Practices Act (FDCPA): Dictates how collectors can behave, not how long records should be kept.

Consumers have rights under:

- Right to Access: They can request access to their account records.

- Right to Dispute: Challenge any inaccuracies or unfair practices.

Practical Implications for Consumers

When dealing with a delinquent account at First Premier:

- Keep Personal Records: Maintain your records of payments, communication, and disputes.

- Stay Informed: Regularly check your account status through online banking or by contacting customer service.

- Legal Actions: If legal action is taken, ensure you keep records to present your case.

Summary of Key Points

To manage your delinquent accounts effectively:

- Understand your bank’s policy on record-keeping.

- Know your rights and the laws that protect you.

- Maintain your own records for reference and dispute resolution.

- Be proactive in managing your financial relationship with First Premier.

By having this knowledge, you can navigate your financial obligations more confidently, especially when it comes to handling overdue accounts and interacting with your bank or financial institution.

How does First Premier determine if an account is delinquent?

+

An account is considered delinquent when the customer misses a payment by the due date, with status increasing at 30, 60, and 90 days past due.

Can I access my account records from First Premier Bank?

+

Yes, as a consumer, you have the right to access your account records, including any pertaining to delinquent accounts, upon request.

What happens if I dispute information related to my delinquent account?

+

If you dispute information, First Premier will conduct an investigation. If the information is found to be inaccurate, it will be corrected or removed from your record.