How Long to Keep Paperwork After Someone Dies: Essential Guide

Handling paperwork and financial matters after the death of a loved one can be overwhelming. Knowing how long to keep various documents can help streamline this process, minimize stress, and ensure compliance with legal requirements. This guide will outline the key types of documents you'll need to retain, for how long, and why it's crucial to keep them.

Why Document Retention is Important

Document retention is more than just a bureaucratic formality; it serves several critical purposes:

- Estate Administration: Proper documentation is necessary for settling the estate, including paying debts, distributing assets, and filing taxes.

- Legal Protection: Keeping documents can provide evidence in case of legal disputes regarding the estate.

- Tax Compliance: The IRS requires certain records to be kept for a specified duration to prevent penalties.

Duration for Keeping Documents

Different documents require different retention periods:

| Document Type | Retention Period |

|---|---|

| Will, Trusts, Estate Planning Documents | Permanently |

| Tax Returns | 3 to 7 years |

| Property Deeds, Titles | Permanently |

| Bank Statements, Financial Records | 7 years |

| Life Insurance Policies | Permanently |

| Death Certificate | Permanently |

| Funeral and Burial Records | Permanently |

| Credit Card Statements | 6 months to 1 year |

| Investment Statements | 7 years |

| Pension/Retirement Account Records | 7 years after distribution |

Steps for Organizing and Retaining Documents

Here's a step-by-step guide to organizing documents post-death:

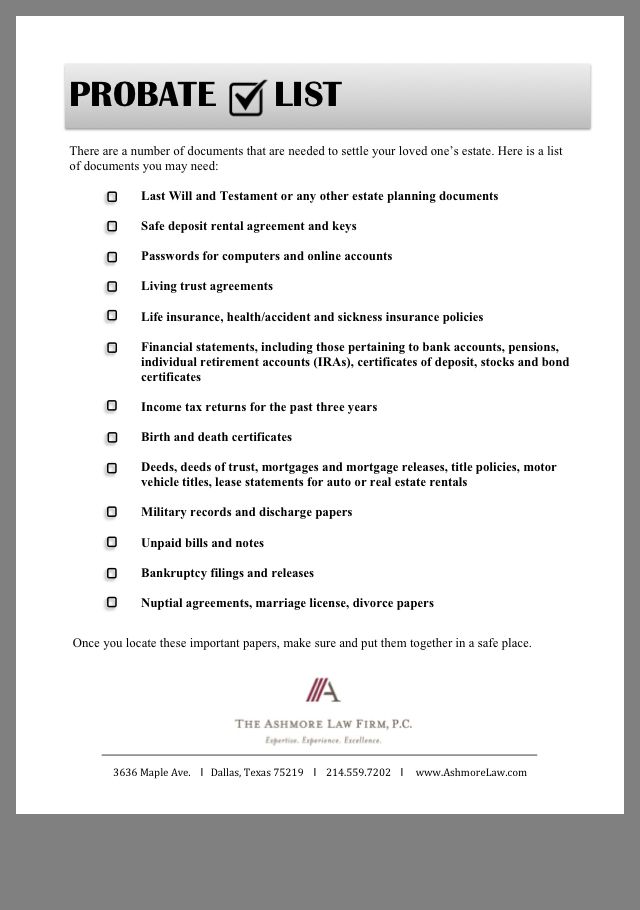

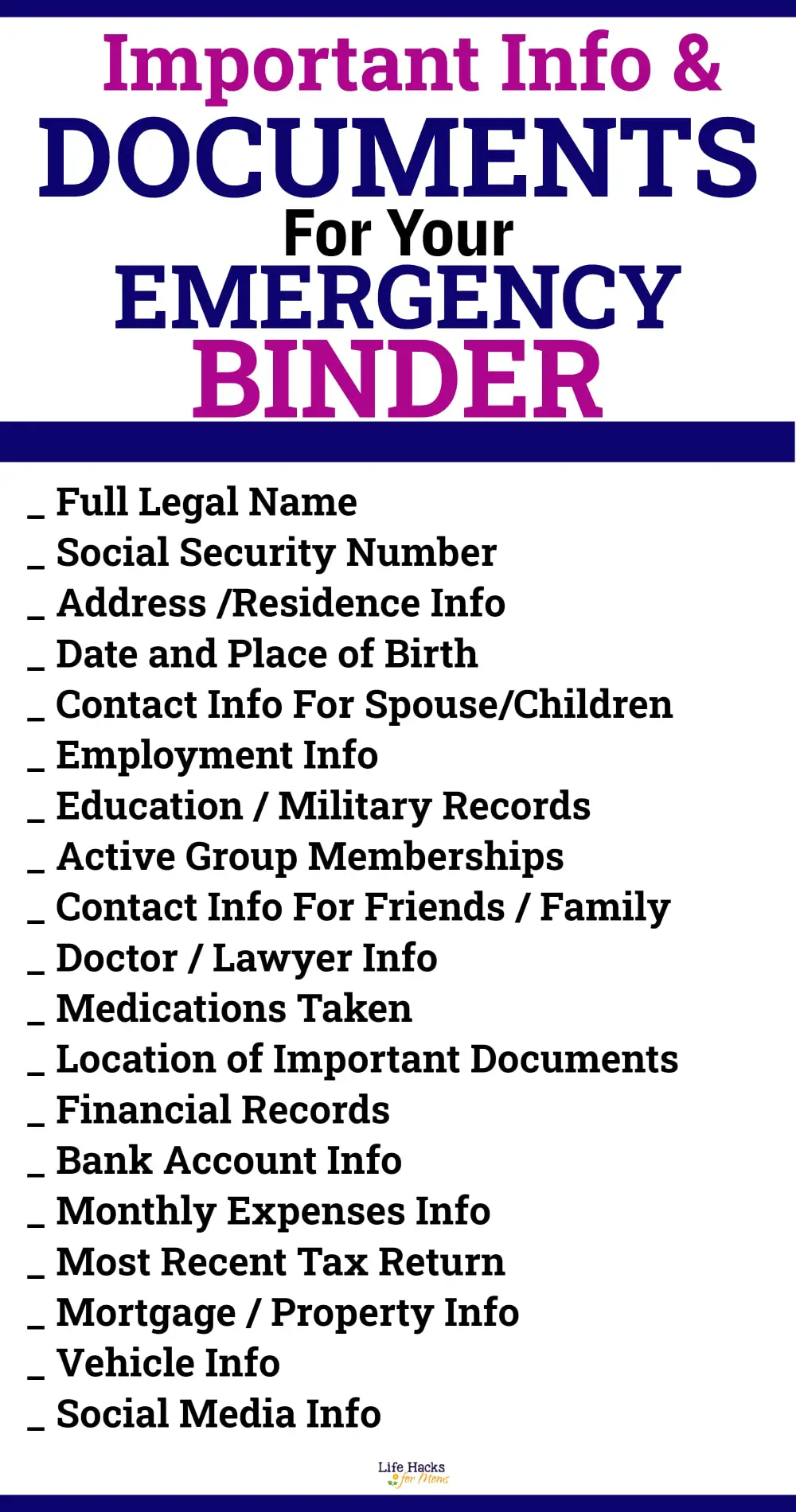

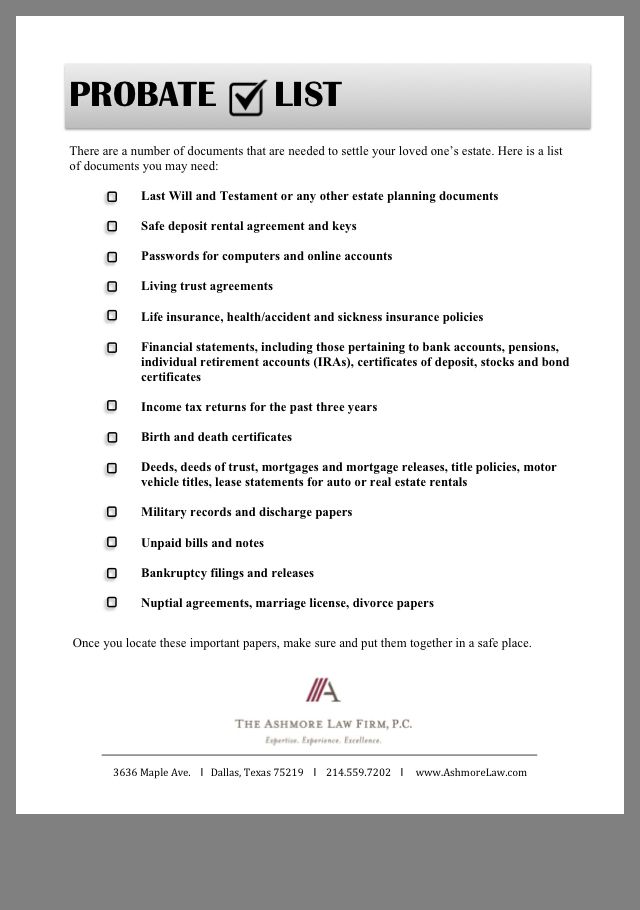

1. Gather Important Documents

- Collect all legal and financial documents including will, trust documents, tax returns, and investment records.

- Retrieve copies of the death certificate; you may need multiple copies for various institutions.

2. Sorting and Categorizing

Organize documents into categories for easier management:

- Legal: Wills, trust documents, legal notifications.

- Financial: Bank statements, investment records, tax documents.

- Insurance: Life, health, property insurance policies.

- Personal: Birth certificates, social security numbers, IDs.

3. Digitize or Photocopy Important Documents

- Scan or photocopy essential documents for backup. This ensures you have access to critical information even if physical documents are lost or damaged.

4. Secure Storage

Choose a safe place for physical documents:

- Use a fireproof and waterproof safe at home.

- Consider a bank safe deposit box for critical documents like the will or property deeds.

- Ensure digital backups are encrypted and stored securely.

5. Review and Destroy

After the appropriate retention period:

- Shred documents that are no longer needed for legal or tax purposes to avoid identity theft.

- Keep in mind which documents must be kept permanently.

🔒 Note: Always review your state's legal requirements for document retention before destroying anything to avoid legal issues.

Key Considerations

Estate Administration and Taxes

Handling the estate includes settling debts, distributing assets, and handling tax obligations:

- Retain tax returns for 3-7 years for potential IRS audits.

- Permanent records like the will and death certificates are crucial.

Life Insurance and Burial Records

Keep these records for:

- Claiming life insurance benefits.

- Maintaining records of burial expenses for tax or reimbursement purposes.

Financial Records

Keep financial records for:

- 7 years for bank statements, investments, and pension records.

- Credit card statements can be kept for 6 months to 1 year unless they’re needed for legal or tax purposes.

Summing up, managing paperwork after the death of someone requires organization, retention, and sometimes, letting go. By understanding which documents to keep, for how long, and why, you can ease the process of estate administration, minimize legal risks, and ensure you're compliant with IRS regulations. Although the immediate aftermath of losing a loved one can be difficult, having an organized approach to document retention can provide clarity and peace of mind during a challenging time.

How long should I keep the deceased’s tax returns?

+

Keep the deceased’s tax returns for 3 to 7 years after their death. This duration allows for potential IRS audits related to their estate or any tax filings made on their behalf.

Do I need to retain credit card statements of the deceased?

+

Yes, keep credit card statements for at least 6 months to a year after death, particularly if they are linked to payments related to legal, estate, or tax matters.

Should I shred all documents after the retention period?

+No, shred documents that no longer serve a legal or tax purpose to prevent identity theft. However, some documents, like the will, property deeds, and insurance policies, should be kept permanently.