5 Must-Know Rules for Annual Paperwork Retention

Navigating the world of annual paperwork can often feel like threading a labyrinth blindfolded. Whether you're at the helm of a business, freelancing, or managing personal finances, understanding how long to keep various documents is crucial for legal compliance, tax audits, and future reference. In this detailed guide, we'll explore the five must-know rules for retaining annual paperwork, offering clarity in the often convoluted realm of document retention.

Rule #1: Follow the Law

Every country has specific regulations concerning document retention periods. For businesses, these laws are typically outlined in tax codes, corporate laws, and labor regulations:

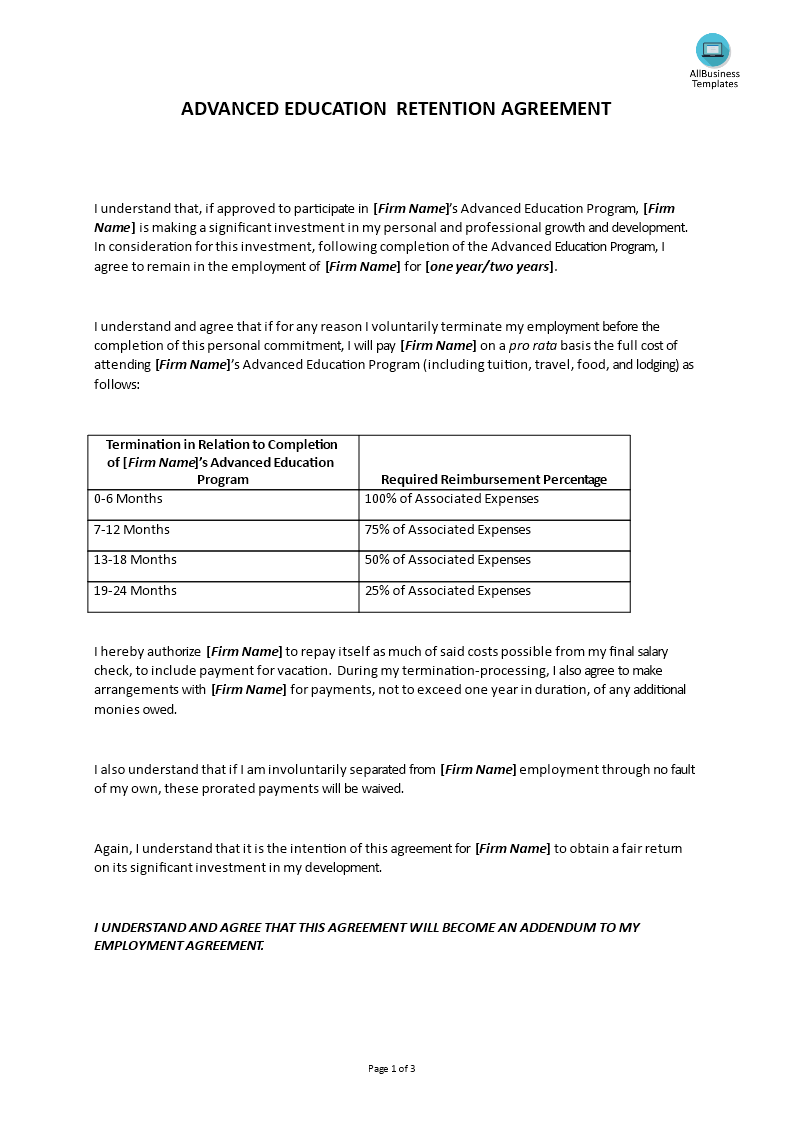

- Retention for Tax Purposes: In the United States, the IRS generally recommends retaining records for at least three years from the date of filing your income tax return. However, in cases of fraud or underreported income, extending to six years might be necessary. Don’t forget about other documents like employment tax records, which must be kept for four years after the tax is due or paid, whichever is later.

- Corporate Documentation: Corporate minutes, shareholder meetings, and significant agreements often need to be kept for as long as the corporation exists.

- Employment Records: Keeping records related to employment conditions, benefits, and worker compensation is often dictated by labor laws.

⚖️ Note: It’s imperative to consult with a legal or tax professional to ensure your retention policies align with current laws.

Rule #2: Preserve Financial Records

Financial records form the backbone of both personal and business accounting:

- Income Statements: These should be retained for a minimum of three to seven years, depending on local regulations.

- Bills, Receipts, and Invoices: Save them for at least three years or the duration of any contract or warranty period.

- Bank Statements: Keep for at least seven years or permanently for business accounts.

- Expense Documentation: Retain for tax purposes, as above, and when related to asset purchases for as long as depreciation is being claimed.

Rule #3: Retain HR and Employment Records

The human resources department is a treasure trove of essential documents:

- Payroll Records: These should be kept for a minimum of three years after the employee’s last payment.

- Employee Contracts, Reviews, and Disciplinary Actions: These should be kept for at least two years after the employee leaves or as required by law.

- Health and Safety Records: In some jurisdictions, health and safety records must be retained indefinitely.

- Workplace Incident Reports: These should be kept for a long-term period to deal with potential lawsuits or inquiries.

Rule #4: Consider Long-Term Retention

Some documents are valuable for much longer than immediate fiscal or legal needs:

- Company Charter and Bylaws: These are retained for as long as the company exists.

- Deeds and Titles: Important to keep these indefinitely as they relate to property and ownership.

- Permanent Records: Items like insurance policies, certain financial statements, and retirement plans often should be retained permanently.

- Backup: Electronic documents should have multiple backups, and physical documents need to be stored in fire-proof, secure locations.

Rule #5: Know When to Shred

Not all paperwork needs to be kept forever, and securely disposing of sensitive information is just as important as retention:

- Confidentiality: Shred documents that contain personal information, financial data, or sensitive business details.

- Expired Records: After the retention period, documents like bank statements or receipts past their useful life can be destroyed.

- Legal Destruction: Follow legal guidelines for document destruction to avoid potential fines or penalties.

- Privacy Concerns: In light of privacy laws like GDPR in Europe, the careful disposal of documents that contain personal data is a must.

In wrapping up, the proper retention of annual paperwork is a balancing act between legal obligations, financial security, and responsible document management. By adhering to these five rules, you can ensure compliance, protect against audits or legal challenges, and maintain organizational integrity. Implementing a clear-cut policy for document retention and shredding will make life easier for you and your organization, providing peace of mind and a streamlined approach to recordkeeping.

Why is it important to keep financial records?

+

Financial records are critical for tax compliance, audits, tracking business performance, and as a defense in case of legal disputes. They also serve as a basis for making informed financial decisions.

How long should I keep my payroll records?

+

Payroll records should be retained for at least three years after the last payment to the employee, though some specific documents might require longer retention periods.

Can I keep all my records digitally?

+

Yes, you can, provided your jurisdiction allows for the electronic storage of records and you have backups to ensure data integrity and availability.

What should I do with expired documents?

+

Expired documents can be shredded or disposed of securely, especially if they contain sensitive information. This ensures compliance with privacy laws and protects against identity theft or data breaches.

Should I retain company bylaws indefinitely?

+

Yes, as they define the governance and operational framework of your company, bylaws should be kept for the entire duration of the company’s existence.