Lien Sale Paperwork: How Long to Keep It?

If you've ever purchased or sold real estate, you're likely familiar with the mountains of paperwork involved in the process. One key question that often comes up, especially after closing the deal, is how long to keep lien sale paperwork? This document trail not only represents legal obligations but also serves as your proof of ownership and financial transactions. In this blog post, we'll explore the importance of maintaining these records, delve into the specifics of what paperwork you need to keep, how long you should keep it, and discuss some practical tips for organizing and storing these documents efficiently.

Understanding the Importance of Lien Sale Paperwork

A lien sale is a legal process by which property is sold to satisfy an unpaid debt. Keeping the paperwork related to a lien sale is crucial for several reasons:

- Proof of Transaction: The paperwork serves as evidence that the transaction occurred, including details like the purchase price, terms of sale, and parties involved.

- Legal Protection: Should any disputes arise over the property, ownership, or financial details, having well-preserved documentation can be your shield against legal challenges.

- Tax Purposes: These documents can be vital when you need to report gains or losses from property sales, especially if there’s a significant tax impact.

- Future Reference: For future sales, modifications, or dealings with the property, past records can be invaluable.

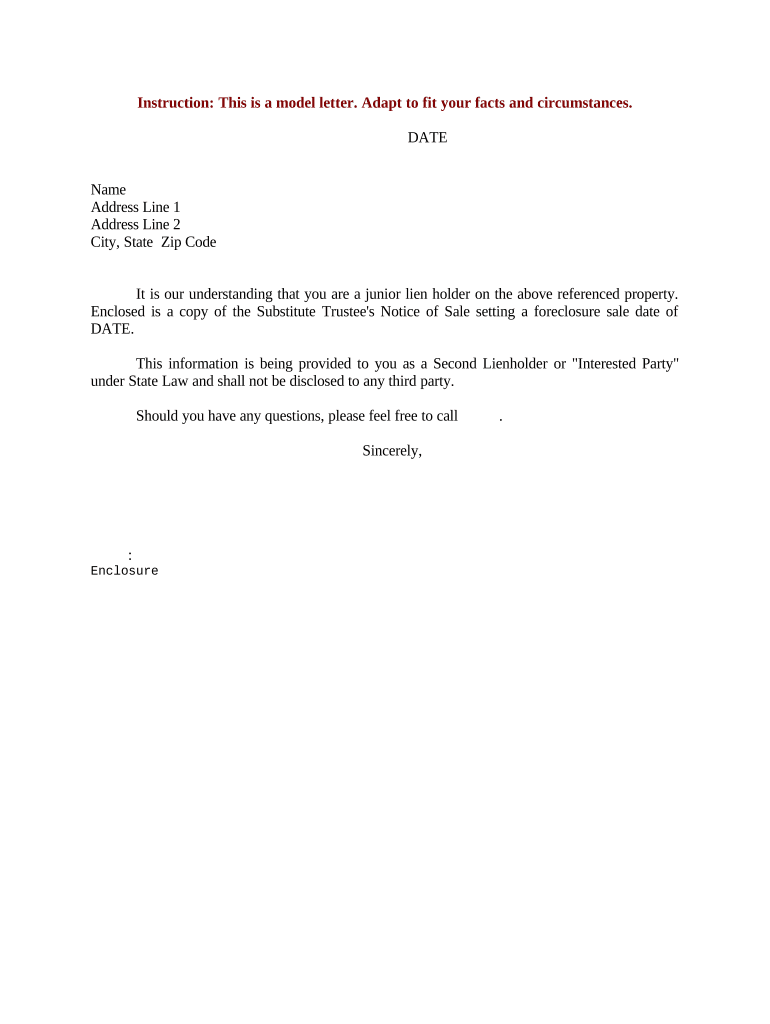

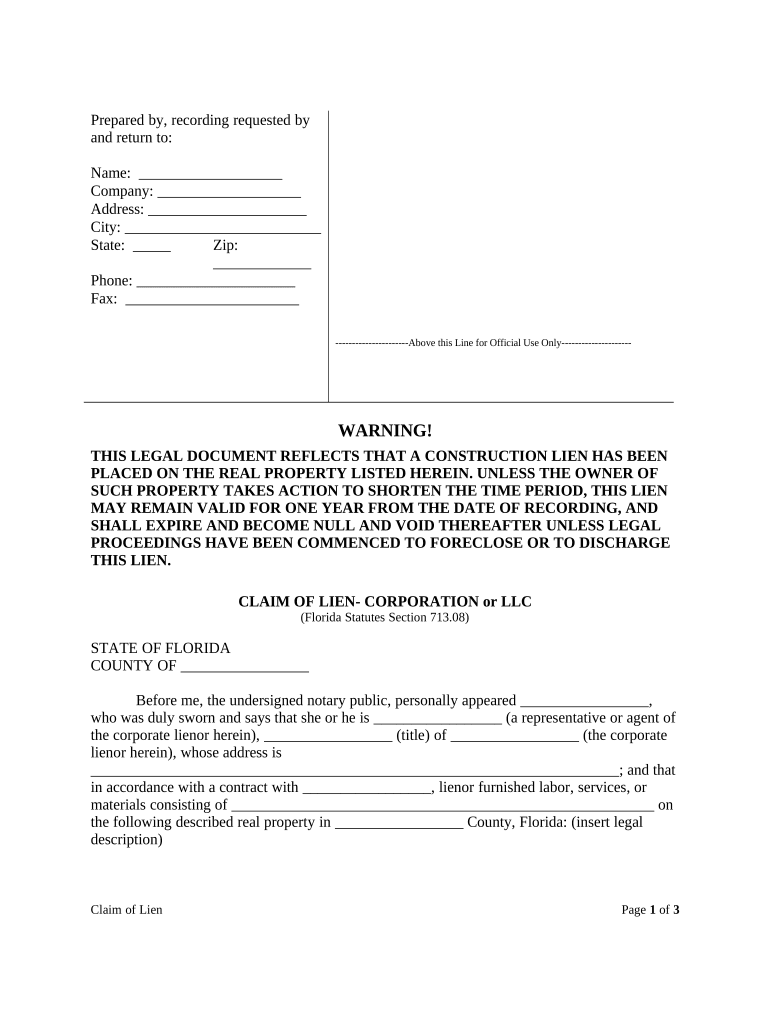

The Paperwork You Should Keep

Here’s a comprehensive list of the lien sale documents you should consider retaining:

| Document | Description |

|---|---|

| Deed | Official document transferring ownership from seller to buyer. |

| Mortgage or Loan Documents | Details of any financing involved in the purchase or sale. |

| Release of Lien | Confirmation that the lien has been paid off and satisfied. |

| Settlement Statement (HUD-1) | Summary of all charges related to the property transaction. |

| Escrow Instructions | Instructions on how escrow funds are to be handled. |

| Tax Forms | Including 1099-S for real estate transactions, necessary for tax reporting. |

| Correspondence with Lenders or Agents | Communications that might be relevant if disputes arise. |

| Appraisals | Assessments of the property’s value, useful for insurance or future sales. |

How Long to Keep Lien Sale Paperwork?

The duration for which you should retain these documents can vary:

- Tax Documents: Generally, the IRS recommends keeping tax-related documents for at least 7 years. Since lien sales can have significant tax implications, keeping these records for this period is advisable.

- Title and Deed: These documents should be kept indefinitely. They are proof of ownership and can be crucial for future sales or property modifications.

- Loan and Mortgage Documents: Hold onto these until the loan is completely paid off, and then keep a copy for your records.

- Escrow Instructions: These should be kept for at least 5 years, or longer if there are ongoing concerns or disputes.

- Other Supporting Documents: While not critical, it’s good practice to keep most real estate documents for 5-7 years. This covers most statute of limitations on legal challenges or claims.

Tips for Organizing and Storing Paperwork

Efficient storage and organization are key:

- Digitize: Scan or photograph all documents. Digital copies can prevent loss or degradation over time and are easier to organize.

- Categorize: Organize documents into categories like ‘Deeds’, ‘Loans’, ‘Taxes’, etc., to find them quickly.

- Secure Storage: Use fireproof safes or secure off-site storage options for hard copies. For digital copies, ensure backups are in a secure, cloud-based storage with appropriate security measures.

- Create an Index: Develop an index or catalog for quick access to specific documents.

- Regular Review: Periodically review your records to eliminate unnecessary clutter while keeping essential documents.

🗝 Note: Never shred or discard important documents without ensuring you have digital or secondary backups.

In Closing

Maintaining the lien sale paperwork is not just a legal obligation; it’s a practice that offers long-term benefits in terms of protection and convenience. By keeping these documents in a well-organized manner for the recommended periods, you safeguard your interests and streamline any future property transactions or legal issues. Remember, while it’s easy to overlook these paper trails, they are a vital part of managing real estate investments wisely.

What should I do if I lose my lien sale paperwork?

+

Immediately contact your lawyer, escrow company, or the entity that facilitated the sale. They should have copies. You can also retrieve deeds and releases of lien from public records offices where property records are stored.

Can I shred my lien sale paperwork after the statute of limitations?

+

Although you might consider shredding after the statute of limitations expires, it’s advisable to keep these records indefinitely for reference. Digital copies could be the solution here, allowing you to shred hard copies safely while retaining important information.

Is digital storage secure enough for these sensitive documents?

+

Yes, if you use reputable cloud storage with robust encryption and password protection. Always have multiple backups in different locations to mitigate any potential data loss.