Florida Disclosure Paperwork: How Long to Keep?

Introduction to Florida Disclosure Paperwork

When you buy or sell property in Florida, it comes with a lot of paperwork—often more than one might expect. This paperwork, known as disclosure paperwork, includes critical documents that reveal important details about the property’s condition, history, and potential issues. Whether you’re a homeowner selling your house or a buyer looking to invest, understanding how long you need to keep these records is crucial for legal protection and financial planning.

Why Keep Florida Disclosure Paperwork?

Disclosure paperwork isn’t just about following the rules. Here’s why it’s worth keeping:

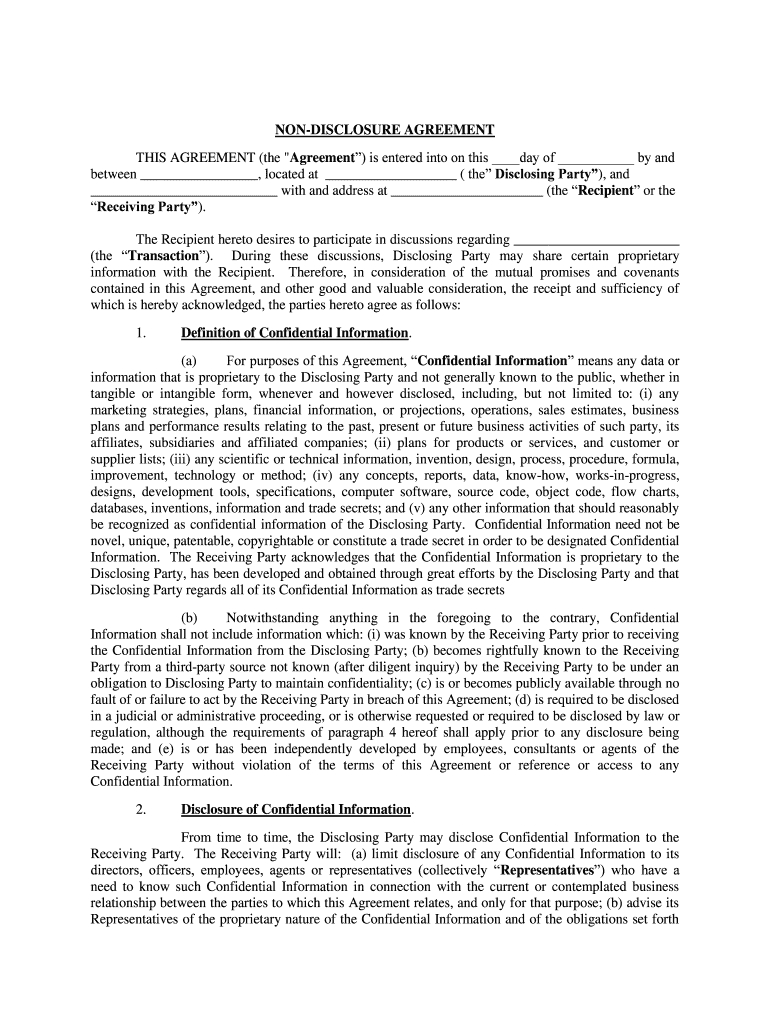

- Legal Requirements: Florida law mandates that sellers provide accurate disclosures about their property. Keeping these documents can serve as evidence of compliance should disputes arise later.

- Dispute Resolution: Should issues surface regarding the condition of the property or undisclosed facts, the paperwork can clarify who was aware of what and when.

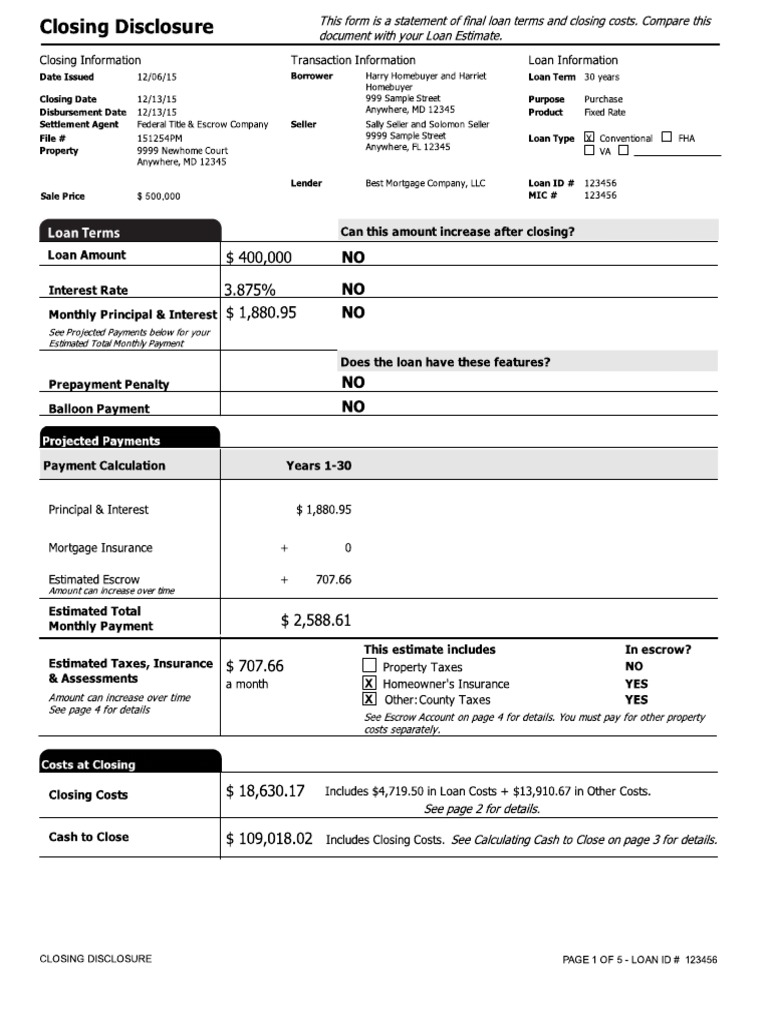

- Tax Purposes: Documents like the Closing Disclosure or HUD-1 Settlement Statement can be vital for tax returns, especially if you’re looking to deduct mortgage interest or real estate taxes.

Types of Florida Disclosure Documents

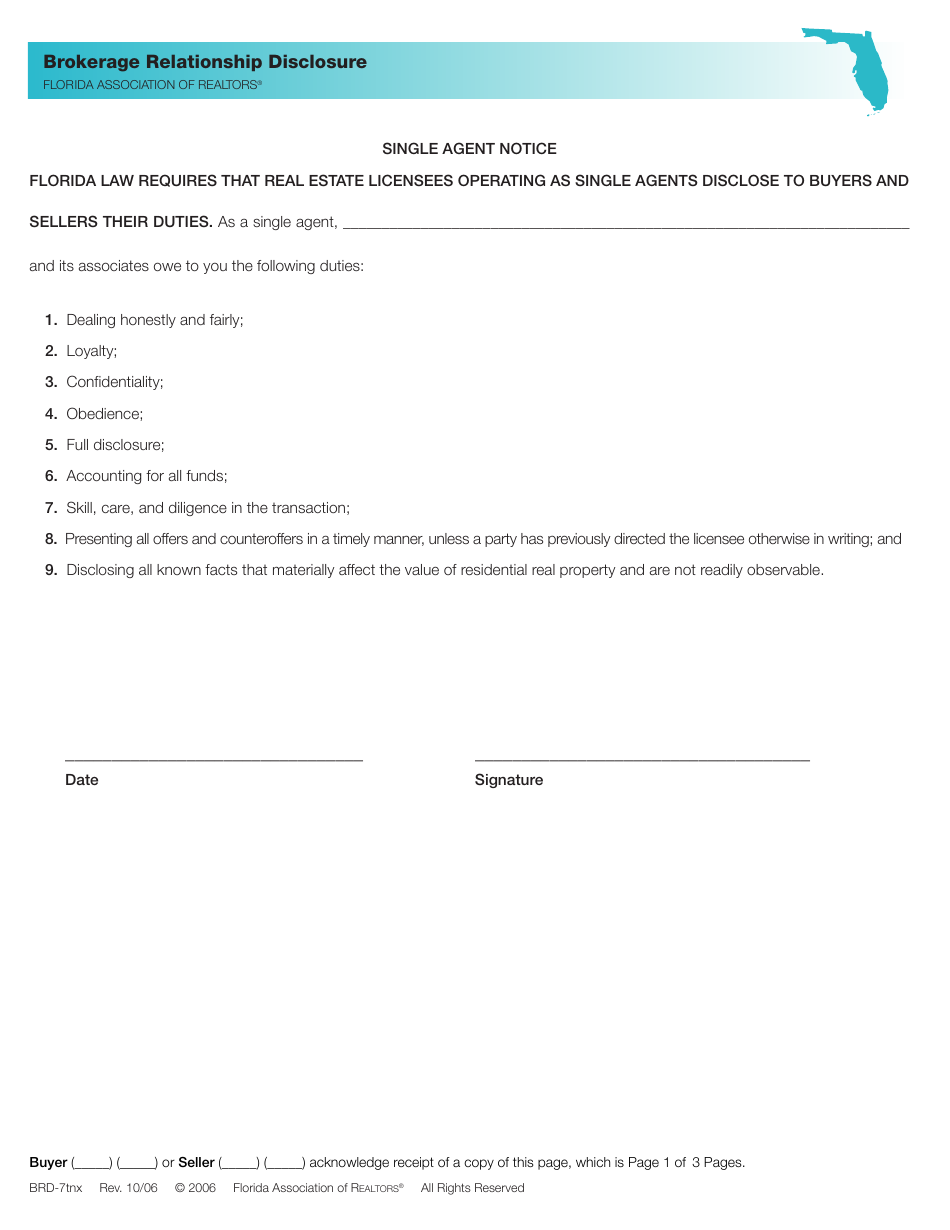

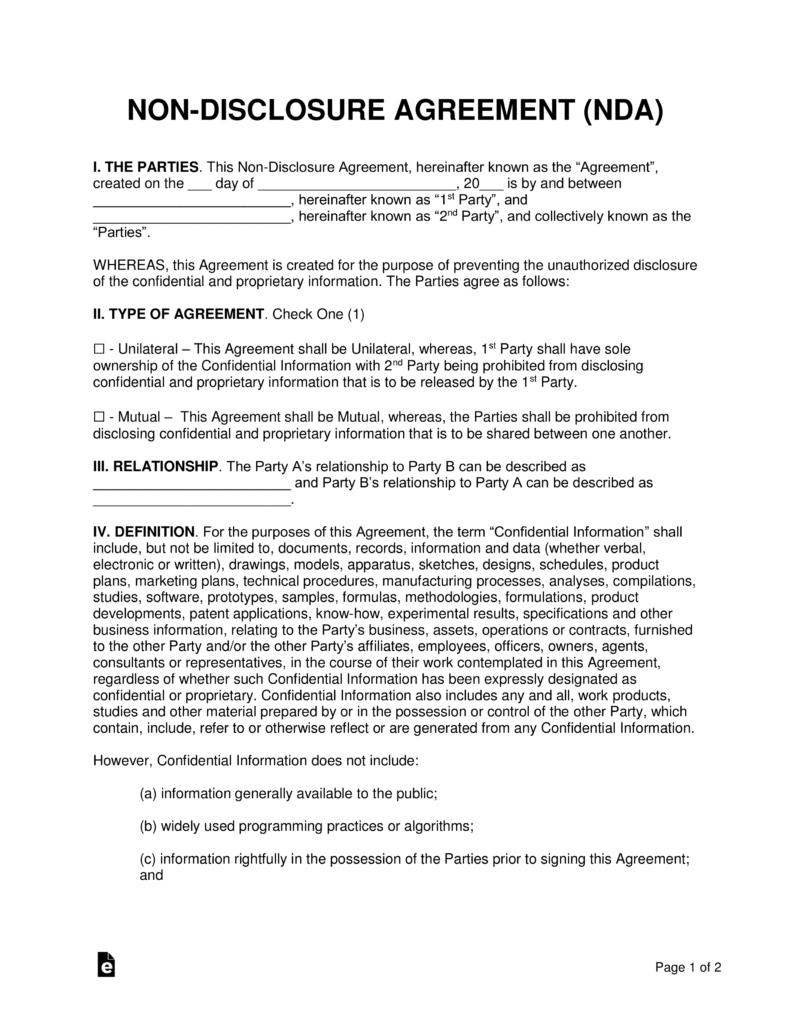

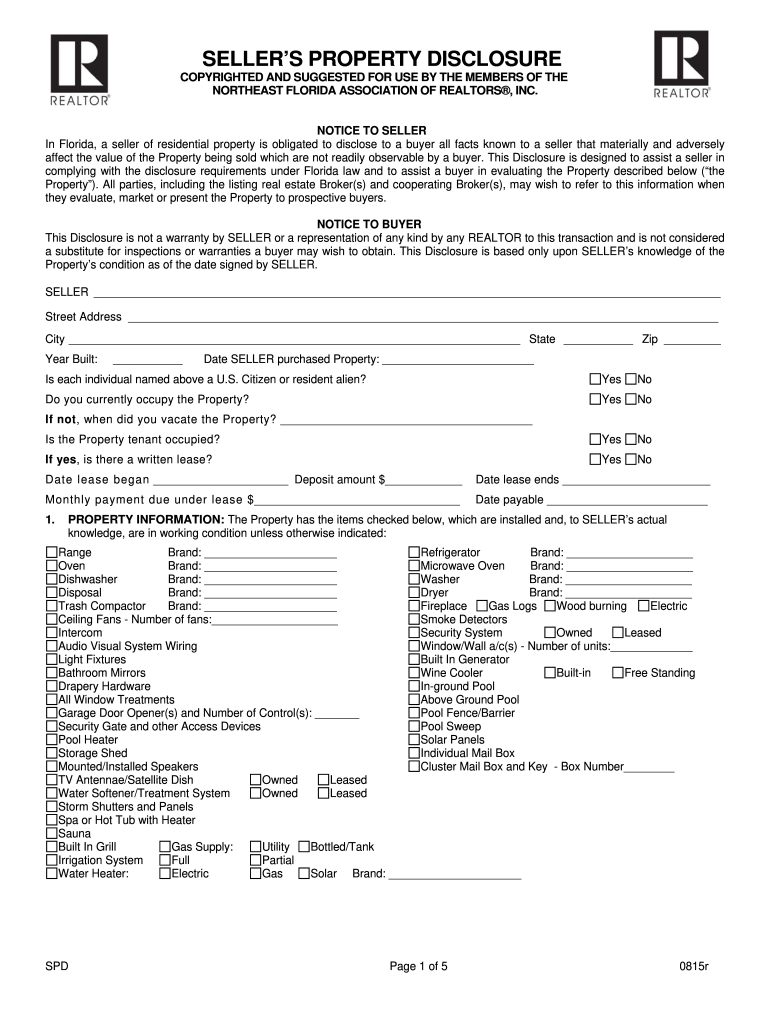

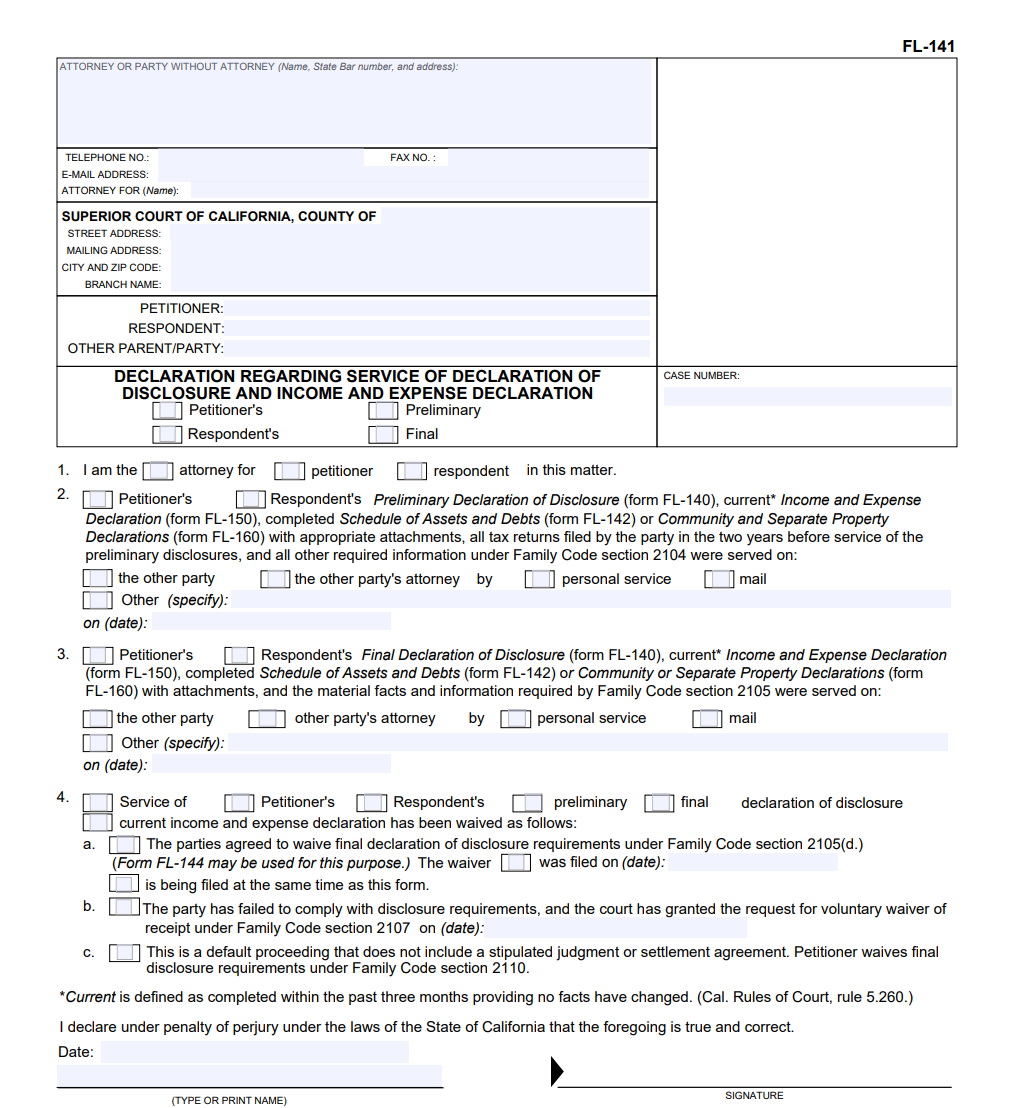

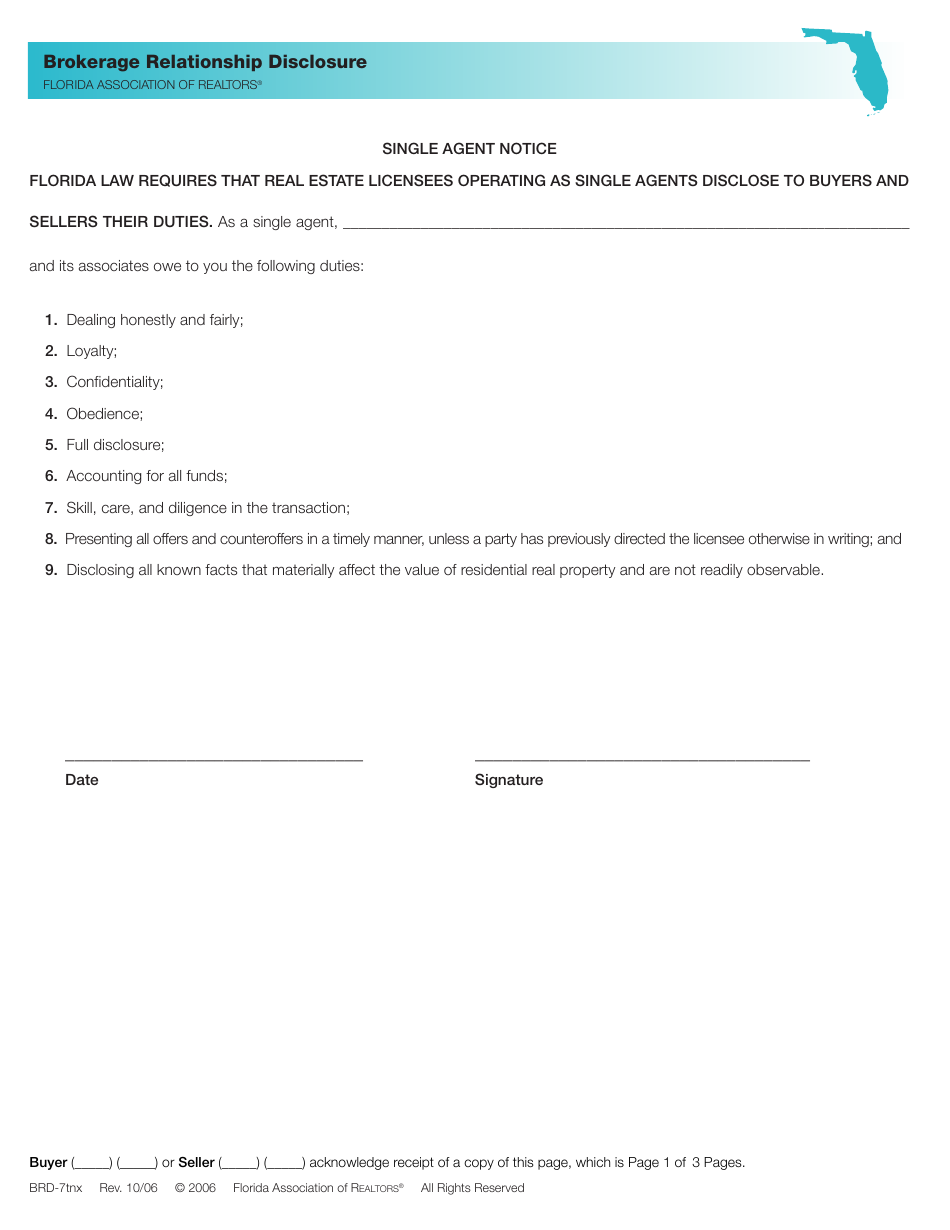

Here are some of the critical Florida disclosure documents you should be aware of:

- Property Condition Disclosure: This document outlines known defects or issues with the property, including past repairs or damage from natural disasters.

- Lead-Based Paint Disclosure: Mandatory for properties built before 1978, this form informs buyers about the presence of lead-based paint hazards.

- Seller’s Disclosure Statement: A general overview of the property, often including details like age of appliances, recent renovations, and any homeowner association (HOA) rules.

- Closing Disclosure: Provides final details about the mortgage loan, closing costs, and transaction details.

How Long Should You Keep Florida Disclosure Paperwork?

The time frame for retaining Florida disclosure paperwork can vary based on the type of document and the potential for future issues:

- General Rule of Thumb: Keep records for at least three to five years after the transaction is completed.

- Property Condition Disclosures: Since these documents can impact future sales or disputes, some recommend holding onto them indefinitely or at least for as long as you own the property.

- Lead-Based Paint Disclosures: Retain for at least five years as advised by the Environmental Protection Agency (EPA).

- Tax-Related Documents: The IRS typically has three years to audit a tax return, but keeping these documents for up to seven years is advisable due to potential delays or extended audits.

📌 Note: The statute of limitations in Florida for most civil actions (including contract disputes) is typically four years from the date of the action or from when the action could have been discovered. Keeping disclosure documents beyond this period might be beneficial if there's any uncertainty or potential long-term issues.

Storing and Organizing Florida Disclosure Paperwork

Managing all this paperwork requires organization:

- Physical Storage: Use fireproof and waterproof storage options for paper documents, such as a safe or a locked file cabinet.

- Electronic Storage: Digitize documents through scanning or taking photos for backup. Store them in password-protected files or cloud storage with encryption for security.

- Systematic Organization: Keep documents in labeled folders by type or by the year of the transaction.

- Access: Make sure important parties (like your spouse, attorney, or real estate agent) know where these documents are stored.

| Document Type | Storage Suggestions |

|---|---|

| Property Condition Disclosure | Digital and physical copies, indefinitely |

| Lead-Based Paint Disclosure | Digital for five years, physical if necessary |

| Closing Disclosure | Digital for seven years, physical for key documents |

| Seller’s Disclosure Statement | Digital and physical copies, indefinitely |

Wrapping Up

Proper management and retention of Florida disclosure paperwork are integral to protecting your interests as a homeowner or investor. By understanding the importance of these documents, knowing how long to keep them, and organizing them systematically, you ensure compliance with legal requirements and prepare for potential future issues. Remember, while retaining these documents can seem cumbersome, the peace of mind and protection they provide are invaluable. Organizing and storing these documents properly can mitigate risks, making your real estate transactions smoother and legally sound.

Do I need to keep all types of Florida disclosure paperwork?

+

While you should keep most disclosure paperwork, especially those related to property condition, defects, and key transactions, some documents like utility bills or minor receipts can be discarded after a short period. Always retain the crucial ones indefinitely or for as long as you own the property.

Can I keep disclosure paperwork only in digital form?

+

While digital storage is convenient, having a physical copy of key documents is also advisable, especially for long-term or legally sensitive documents like property deeds or closing statements. Ensure digital copies are backed up securely.

What happens if I don’t keep my disclosure paperwork?

+

If disputes arise, not having documentation to back up your claims or to show that you complied with disclosure requirements can make legal proceedings more difficult. It can also complicate tax filings and could lead to penalties if you’re unable to substantiate your deductions.

Can I request copies of disclosure paperwork from my real estate agent or attorney?

+

Yes, you can request copies of documents from your real estate agent or attorney. They are usually required to keep records of transactions, so you can ask for these documents if you’ve lost or misplaced your copies.

Are there any documents I can safely discard after a certain time?

+

Documents like utility bills, routine maintenance receipts, or minor home improvement records can be discarded after a year or two unless they’re relevant to ongoing home warranty claims or tax audits. Always keep documents that are crucial for legal disputes or tax purposes longer.