How to Obtain Your EIN Documents Easily

In the world of business, obtaining an Employer Identification Number (EIN) is a crucial step for many entities. Whether you're starting a new business, managing a non-profit, or dealing with tax matters, having your EIN documents is essential. This comprehensive guide will walk you through the process of obtaining your EIN documents easily, ensuring you understand every step and are equipped with all necessary knowledge.

Understanding the Importance of EIN Documents

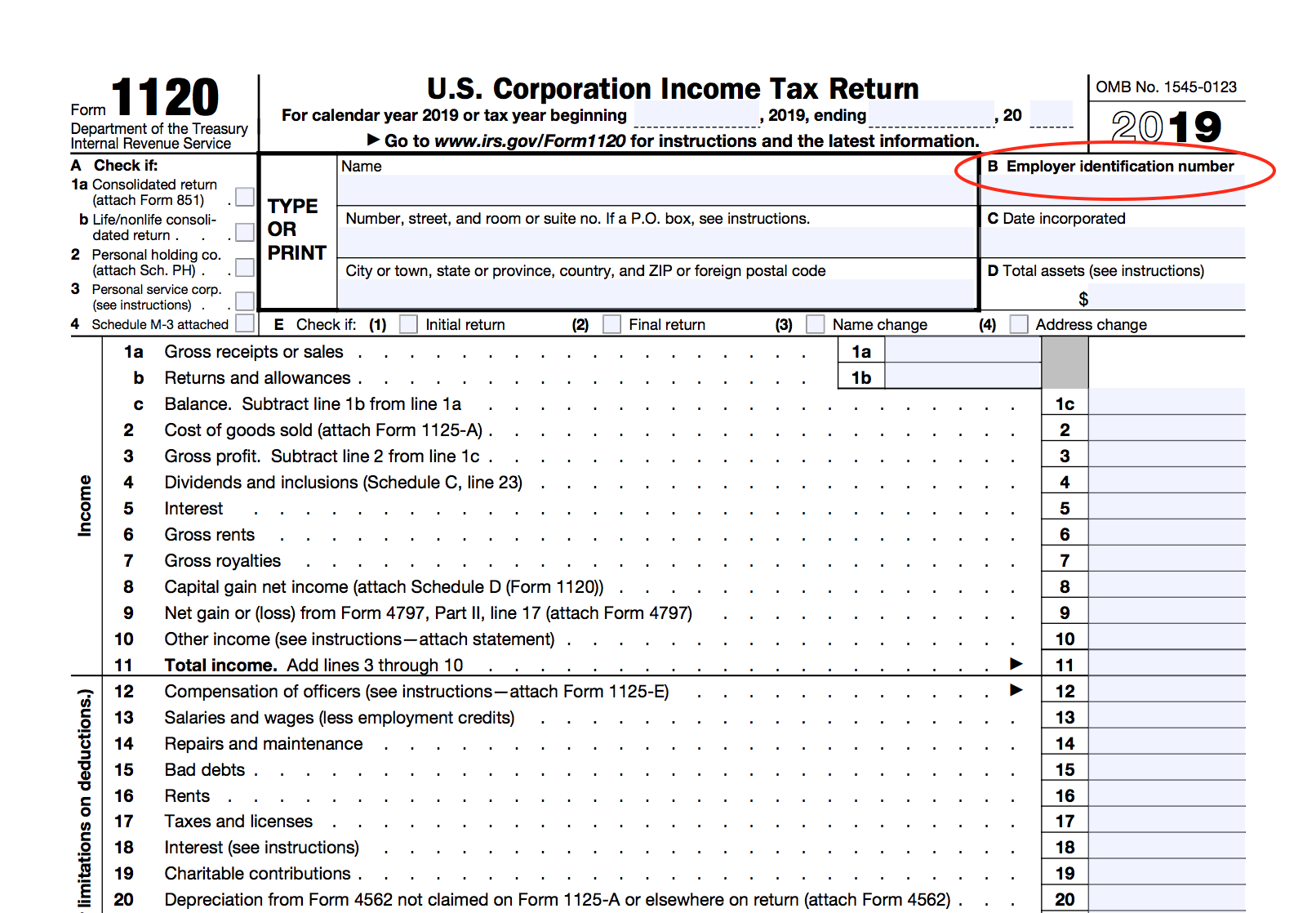

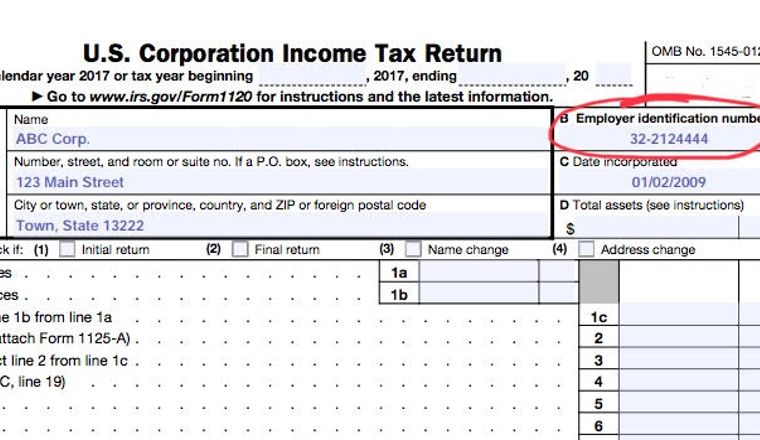

An Employer Identification Number (EIN), also known as a Federal Tax Identification Number, is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to business entities operating in the United States. Here’s why your EIN documents are vital:

- Tax Filing: Required for filing federal taxes, opening business bank accounts, and hiring employees.

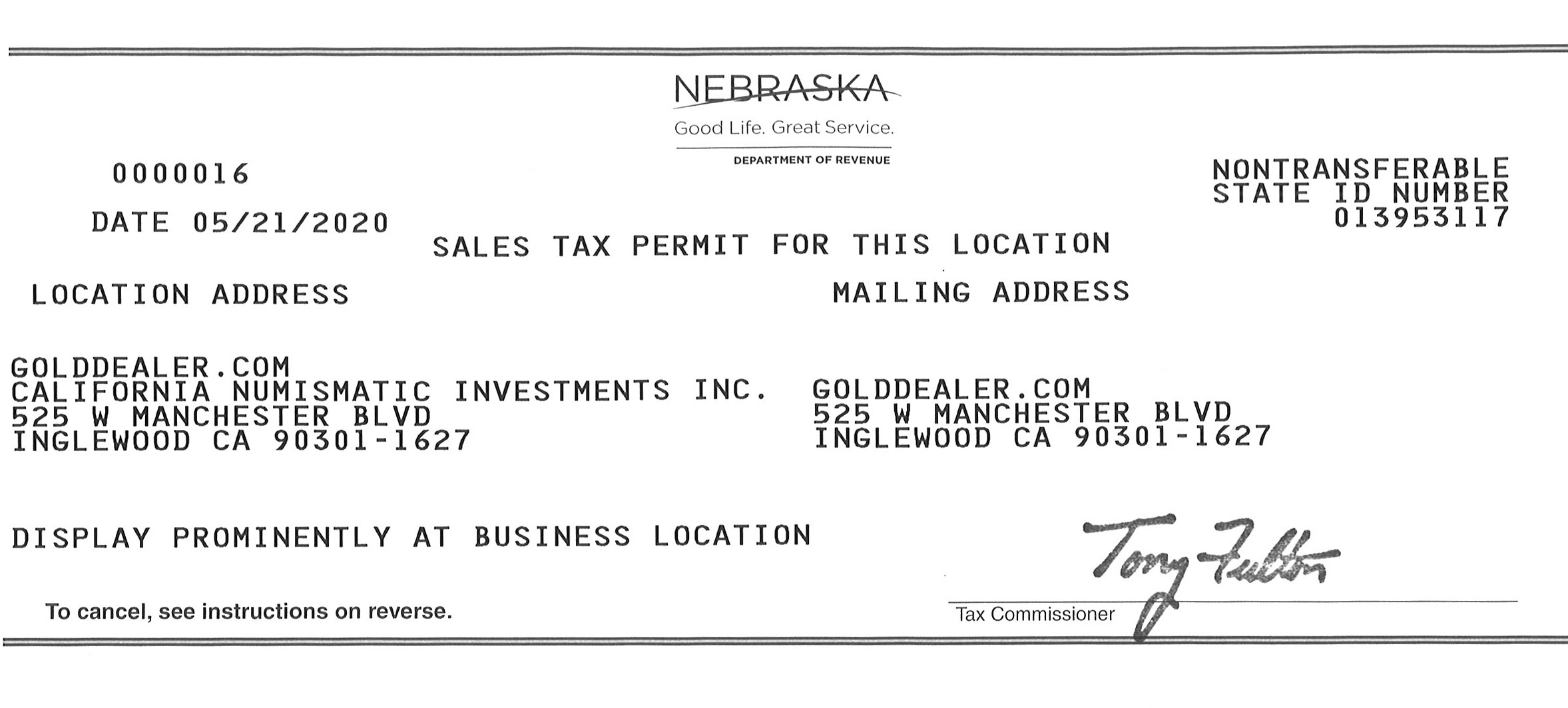

- Business Operations: Necessary for business transactions, credit applications, and establishing your business identity.

- Legal Documentation: Used to establish your business’s legal entity in various legal documents, contracts, and agreements.

Steps to Obtain Your EIN Documents

Here’s how to apply for and secure your EIN:

1. Eligibility Check

Before you apply, ensure your business entity falls under one of these categories:

- Corporations, including LLCs.

- Sole Proprietors with employees, partnerships, and S-Corporations.

- Trusts, Estates, or Non-Profit Organizations.

- Some other categories, such as farms, real estate mortgage investment conduits, or pension plan administrations.

2. Application Process

There are several ways to apply for an EIN:

- Online Application: Visit the IRS website (here) where you can apply online. This is the fastest way to get your EIN as it provides immediate access to your number.

- By Mail or Fax: Fill out Form SS-4 and send it to the IRS by mail or fax.

- Phone Application: If your business has a principal place of business or legal residence outside the United States, or you can’t apply online, call the IRS for an EIN.

📝 Note: Online application is the quickest method, but other methods might be necessary for specific cases.

3. Document Preparation

Before applying, have these documents ready:

| Document | Purpose |

|---|---|

| Legal Business Name | To verify the identity of your business. |

| Responsible Party Information | Name, SSN/ITIN, address, and title of the person with control over or substantial interest in the business. |

| Business Type | The type of entity (corporation, partnership, sole proprietorship, etc.). |

| Mailing Address | Where you want to receive your EIN confirmation letter. |

| Physical Location | Where your business operates, if different from the mailing address. |

| Reason for Applying | Why you need an EIN (e.g., starting a new business, changing type of organization, etc.). |

4. Application Submission

Once you have all your documents:

- Online: Fill out the form on the IRS website and submit it.

- By Fax or Mail: Send Form SS-4 to the appropriate IRS address or fax number.

- By Phone: Call the IRS at the international number provided for non-U.S. businesses.

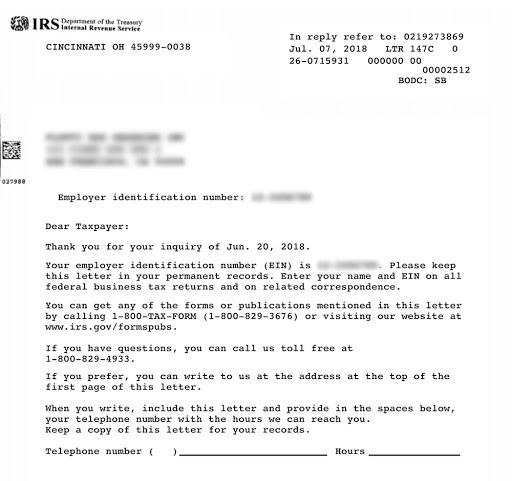

5. Receiving Your EIN

After submission:

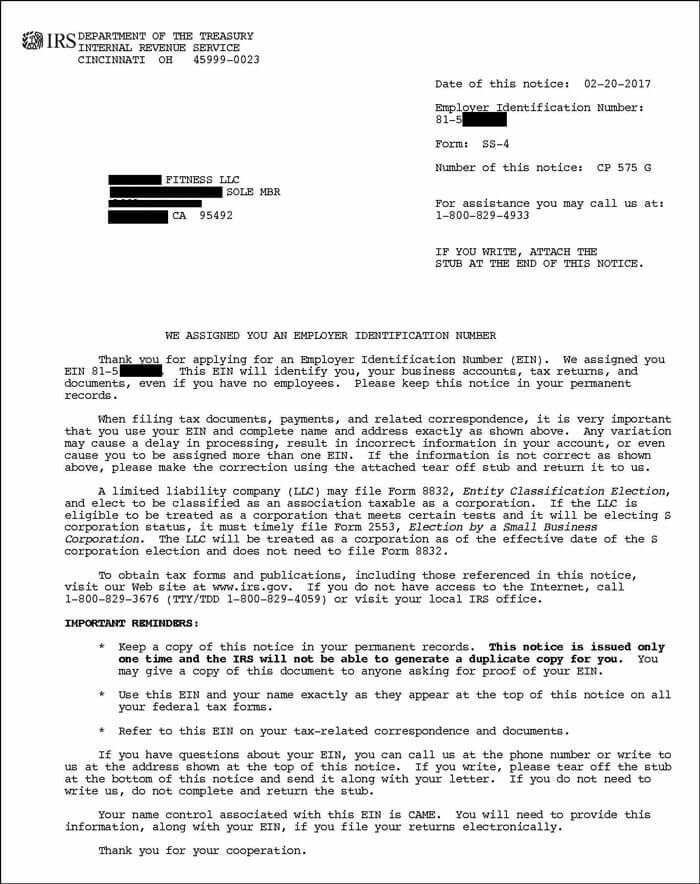

- Online: You’ll receive an immediate download of your EIN confirmation letter.

- Fax or Mail: You’ll receive your EIN via mail or fax (1-5 business days for fax, up to 4 weeks for mail).

- Phone: The number will be given to you immediately over the phone.

Keeping Your EIN Documents Secure

Once you have your EIN, it’s crucial to:

- Print and store a copy of your confirmation letter in a secure location.

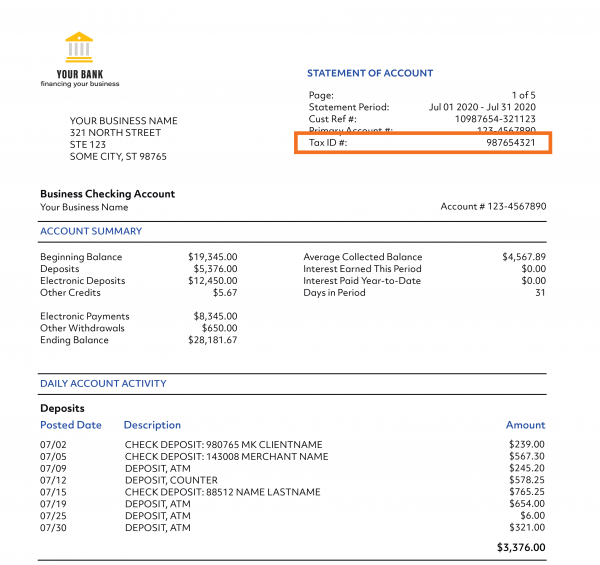

- Use it to open bank accounts, apply for business licenses, and complete other legal or financial transactions.

- Be cautious when sharing your EIN; treat it like you would your Social Security Number.

🔐 Note: Keep your EIN documents confidential to prevent identity theft or fraudulent use.

Wrapping Up

Obtaining your EIN documents might seem like a daunting process, but with this guide, you’re well-equipped to manage it efficiently. Remember, your EIN is not just a number; it’s your business’s identity in the eyes of federal and state tax agencies. With an EIN, your business can operate legally, file taxes, hire employees, and engage in financial transactions. By following the steps outlined above, you can ensure you have your EIN documents when you need them, making your business journey smoother and more legally secure.

Can I apply for an EIN if I am not a U.S. citizen?

+

Yes, you can apply for an EIN as a non-U.S. citizen. However, you must have a valid Taxpayer Identification Number (ITIN) or Social Security Number (SSN).

What should I do if I lose my EIN document?

+

If you lose your EIN document, you can call the IRS Business and Specialty Tax Line at 1-800-829-4933, or find it on past tax returns or business correspondence with the IRS.

Is it necessary for a sole proprietorship without employees to get an EIN?

+

While not legally required, it can be beneficial for a sole proprietorship to obtain an EIN to separate personal and business finances, hire employees later, or open a business bank account.