Creating a Balance Sheet in Excel: A Simple Guide

Managing your finances, whether for personal use or business, is crucial for ensuring stability and growth. One of the foundational tools in financial management is the balance sheet. This financial statement provides a snapshot of your financial health at any given time by listing your assets, liabilities, and owner's equity. In this guide, we'll walk through the process of creating a balance sheet in Microsoft Excel, making this complex task simpler and more accessible.

Why Use Excel for a Balance Sheet?

Microsoft Excel is a powerful tool with features that can help in organizing financial data efficiently:

- Automatic calculations - No need to perform manual calculations; Excel does it for you.

- Data validation - Ensure the accuracy of input data with data validation rules.

- Formulas - Utilize complex financial formulas easily.

- Charting - Visualize your financial data with graphs and charts.

- Formatting - Present your data in a neat, professional format.

Setting Up Your Excel Spreadsheet

Here’s how to set up your balance sheet in Excel:

- Open Microsoft Excel and start a new blank workbook.

- Click on any cell and type “Company Balance Sheet” or a title that suits your needs.

- Leave a row empty for aesthetics, then in cells A1, B1, and C1, write “Assets”, “Liabilities”, and “Owner’s Equity” respectively.

- Below each heading, you’ll list the respective items:

- Under Assets, you might include:

- Cash

- Accounts Receivable

- Inventory

- Prepaid Expenses

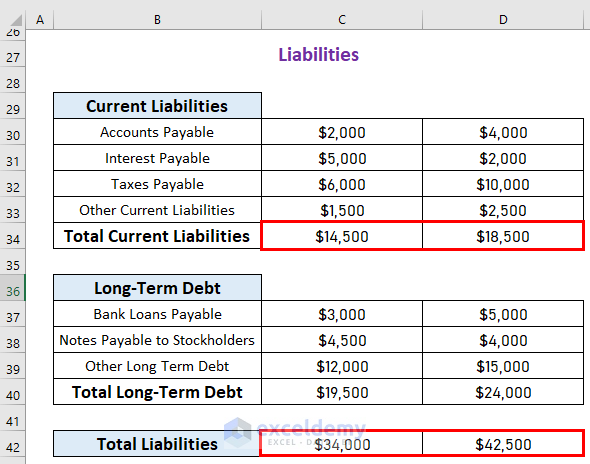

- Under Liabilities:

- Accounts Payable

- Short-term Debt

- Accrued Liabilities

- Long-term Debt

- Under Owner’s Equity:

- Owner’s Capital

- Retained Earnings

📝 Note: The items listed under assets, liabilities, and owner's equity can vary based on the type of business or individual financial situation. Always customize your sheet to match your unique circumstances.

Filling in Your Balance Sheet

With your sheet set up, follow these steps to populate it:

- Enter the figures for each asset, liability, and equity item. If you don’t have exact numbers, estimate initially.

- Use Excel formulas to sum up categories:

- In cell A10, type “=SUM(A4:A9)” to total the assets.

- Similarly, calculate the total for liabilities and owner’s equity in cells B10 and C10.

- Ensure that the total Assets equal the sum of Liabilities and Owner’s Equity. This is a fundamental accounting principle.

| Item | Formula |

|---|---|

| Total Assets | =SUM(A4:A9) |

| Total Liabilities | =SUM(B4:B9) |

| Total Owner’s Equity | =SUM(C4:C9) |

💡 Note: For simplicity, this guide uses fixed cell ranges. In actual practice, your ranges might differ based on how many items you've listed.

Formatting and Finalizing Your Balance Sheet

Excel offers various tools to make your balance sheet visually appealing and easy to understand:

- Bold the headings and total figures to make them stand out.

- Add borders around cells to separate sections clearly.

- Apply conditional formatting to highlight negative numbers or other significant financial indicators.

- Include a date range to indicate the period covered by the balance sheet.

Ensuring Accuracy and Updating

To keep your balance sheet accurate:

- Regularly update your balance sheet to reflect changes in assets, liabilities, or owner’s equity.

- Use Excel’s auditing tools to check for formula errors.

- Consider having a third party review your balance sheet for accuracy.

Creating a balance sheet in Excel is an invaluable skill for understanding your financial position. By following this guide, you've learned how to set up, populate, format, and maintain a balance sheet using Excel's features. Remember, a well-constructed balance sheet not only helps in making informed financial decisions but also aids in presenting your financial health to stakeholders, potential investors, or for your personal financial planning.

What are the key components of a balance sheet?

+

The key components are assets (what you own), liabilities (what you owe), and owner’s equity (the remaining interest in the assets after deducting liabilities).

Why must assets equal liabilities plus owner’s equity?

+

This equation represents the fundamental accounting equation: Assets = Liabilities + Owner’s Equity, reflecting the balance between resources owned and claims against those resources.

Can Excel calculate my balance sheet automatically?

+

Yes, with the correct formulas in place, Excel can automatically calculate the totals for each section of the balance sheet, ensuring all figures balance according to accounting principles.