Easy Steps to Create a Balance Sheet in Excel

Introduction to Balance Sheets

Creating a balance sheet in Excel is an essential skill for anyone interested in accounting, finance, or managing a business. The balance sheet is one of the three key financial statements used by stakeholders to evaluate the financial health of an entity at a specific point in time. It provides a snapshot of the company’s assets, liabilities, and equity, giving insights into its solvency and financial stability. This post will guide you through the straightforward steps to create an effective balance sheet in Microsoft Excel.

Setting Up Your Excel Workbook

Before diving into the actual creation of the balance sheet, setting up your Excel workbook appropriately is crucial for clarity and organization:

- Open Microsoft Excel: Ensure you have a clean, empty workbook.

- Select the Number of Sheets: Typically, one sheet is enough for a simple balance sheet, but for more detailed analysis or comparisons, consider using multiple sheets.

- Naming: Rename the sheet to reflect its content, like "Balance Sheet 2023."

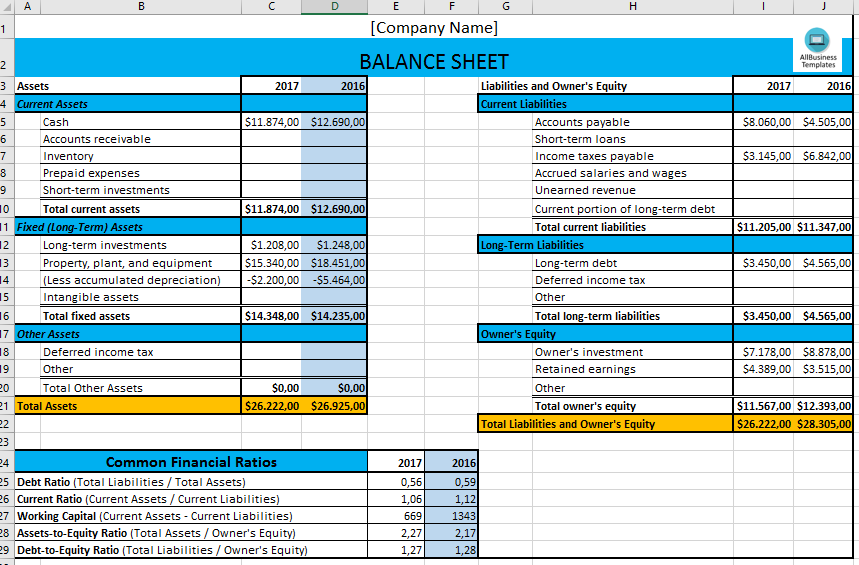

Layout Planning

Organizing your balance sheet effectively involves:

- Assets: Current and Non-Current

- Liabilities: Current and Long-Term

- Equity: Various components of shareholder equity

Here’s how you can set up the layout:

- Column A for headers.

- Columns B, C, D for last year, this year, and year-over-year change respectively.

⚠️ Note: The choice of layout will depend on how detailed you want your balance sheet to be.

Entering the Balance Sheet Data

Let’s proceed to populate the balance sheet:

Assets

- Current Assets:

- Cash and Cash Equivalents

- Marketable Securities

- Accounts Receivable

- Inventory

- Prepaid Expenses

<table>

<tr>

<th>Asset Type</th>

<th>Current Year</th>

<th>Last Year</th>

<th>% Change</th>

</tr>

<tr>

<td>Cash</td>

<td>35,000</td>

<td>30,000</td>

<td>16.67%</td>

</tr>

<tr>

<td>Accounts Receivable</td>

<td>5,000</td>

<td>4,500</td>

<td>11.11%</td>

</tr>

</table>

- Non-Current Assets:

- Property, Plant, and Equipment

- Intangible Assets

- Long-Term Investments

Liabilities

Current Liabilities:

- Accounts Payable

- Short-Term Debt

- Accrued Expenses

Non-Current Liabilities:

- Long-Term Debt

- Deferred Tax Liabilities

Equity

- Share Capital

- Retained Earnings

- Accumulated Other Comprehensive Income

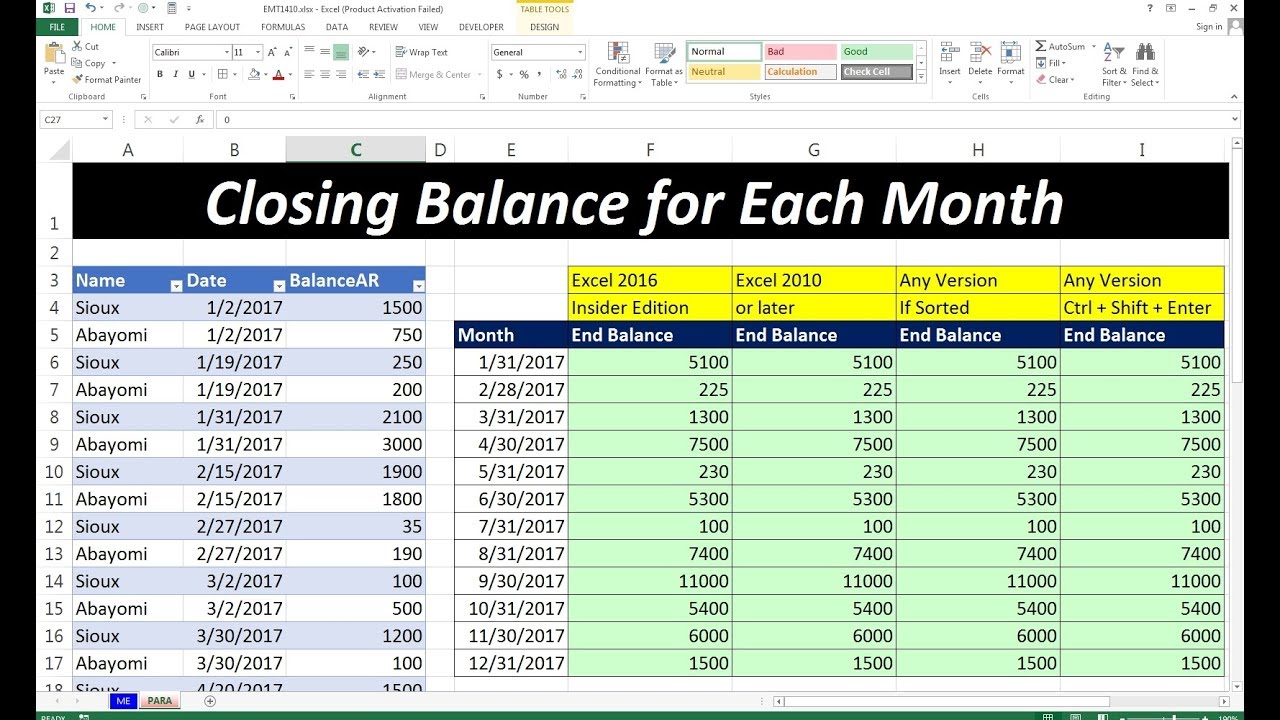

Formulas and Calculations

Now, let’s focus on the formulas to ensure the balance sheet is correct:

- Total Assets: Sum all asset entries.

- Total Liabilities: Sum all liability entries.

- Equity: Total Assets - Total Liabilities

📝 Note: Excel can automatically calculate the balance using the formula: =B5+B6+B7-(-B15-B16-B17) assuming assets are from row 5 to 7 and liabilities from row 15 to 17.

Formatting for Clarity

Making your balance sheet easy to read and understand is as important as the data itself:

- Use conditional formatting to highlight changes, increases, or decreases in values.

- Apply cell borders to separate sections clearly.

- Format numerical values with the appropriate currency and decimal points.

- Bold and Italicize headers and key totals for emphasis.

Analyzing the Balance Sheet

After setting up your balance sheet, take time to analyze it:

- Liquidity Ratios: Assess how easily assets can be converted into cash to cover short-term liabilities.

- Debt to Equity Ratio: Understand the company’s financial leverage.

- Trends Analysis: Compare year-over-year changes to see the growth or decline in financial health.

In wrapping up, creating a balance sheet in Excel not only helps in understanding the financial position but also equips you with the tools to make informed decisions. The key points to remember are setting up your workbook correctly, entering accurate data, using formulas for calculations, ensuring clear formatting, and analyzing the information for business insights. Whether you’re a small business owner, a student, or a financial analyst, mastering this skill will provide you with a powerful tool for financial analysis and reporting.

How often should I update the balance sheet?

+

A balance sheet should be updated at least quarterly, but for a more detailed analysis, monthly updates can be beneficial.

Can I use templates to create a balance sheet?

+

Yes, using templates can save time, but ensure they are customizable to fit your specific needs and comply with accounting standards.

What are common errors when creating a balance sheet in Excel?

+

Common errors include: Misclassifying assets or liabilities, not accounting for depreciation, and errors in formula input leading to incorrect totals.