Using Administrator Paperwork Across Multiple States: Is It Possible?

The issue of navigating administrative paperwork can be overwhelming, particularly when your professional responsibilities span multiple states. Whether you're a business owner managing operations in several locations or an individual coordinating legal matters or benefits across different state lines, understanding how to streamline your documentation process is crucial. This comprehensive guide explores the challenges and solutions for using administrator paperwork across multiple states efficiently.

Understanding the Basics of Administrative Paperwork

Administrative paperwork includes documents needed for compliance, legal filings, tax submissions, benefits administration, and more. Each state has its own laws, regulations, and required forms, which can complicate management when dealing with several jurisdictions.

Types of Documents

- Business Licenses and Permits: Each state requires different forms for business operations.

- Tax Documents: State taxes can vary significantly, affecting how businesses report income, sales, and property taxes.

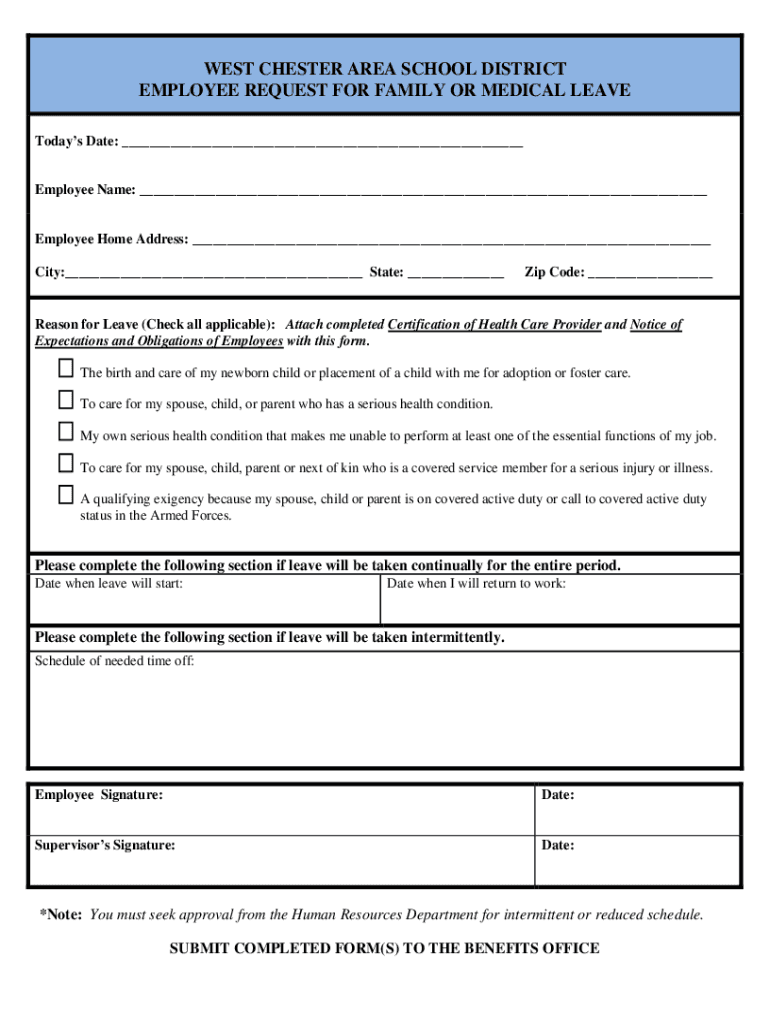

- Employee Benefits and Payroll: States have unique regulations for employment practices, health insurance, workers' compensation, and retirement plans.

- Legal and Compliance Documents: Contracts, agreements, and compliance filings that must adhere to state-specific laws.

Challenges with Multi-State Paperwork

Handling administrative tasks across different states comes with several challenges:

- Regulatory Variations: Each state can have differing business practices, tax structures, and legal requirements, making compliance complex.

- Information Overload: Keeping track of deadlines, renewals, and amendments for each state's documentation can be daunting.

- Cost and Time: Filing separately in each state can increase administrative costs and time spent on paperwork.

Solutions for Streamlined Management

Leveraging Technology

Modern software solutions can greatly assist in managing multi-state paperwork:

- Cloud-Based Document Management: Platforms like Google Drive, Dropbox, or specialized compliance software allow access to documents from any location.

- Automated Compliance: Tools that track compliance deadlines and automatically fill forms can reduce errors and missed dates.

- APIs and Integrations: Integrating various software can streamline workflows, ensuring data consistency across documents and systems.

Consulting with Experts

Outsourcing or hiring specialists can ease the burden:

- Compliance Consulting Firms: They provide expert guidance on state-specific requirements.

- Legal Advisors: For intricate legal documents and filings, having legal counsel knowledgeable in multi-state issues is invaluable.

🚨 Note: Always ensure that any software or service provider complies with data privacy and security standards to protect sensitive information.

Creating a Unified Strategy

Develop an organizational strategy to handle documents:

- Central Repository: Maintain a single source of truth for all documents with proper organization and access controls.

- Standardized Forms: Where possible, use standardized forms or templates to reduce the variability in document preparation.

- Internal Policies: Establish clear internal policies for document handling, retention, and destruction in line with each state’s laws.

Case Studies: Effective Multi-State Management

Case Study 1: A Regional Healthcare Provider

A healthcare provider operating facilities in multiple states faced challenges with varying licensure and compliance requirements. By:

- Implementing a comprehensive document management system.

- Engaging with consultants to stay ahead of regulatory changes.

- Using state-specific templates for internal documents, they improved efficiency and reduced compliance risks.

Case Study 2: E-Commerce Business Expansion

An e-commerce company expanding nationally needed to manage sales tax collection and reporting for each state:

- They utilized a cloud-based tax software that handled state-specific tax rules automatically.

- Maintained a close relationship with a multi-state tax advisor to navigate complex tax laws.

- Resulted in a 50% reduction in administrative workload related to tax compliance.

💡 Note: Regular audits and reviews of your compliance strategy are essential to adapt to changes in state laws and to ensure ongoing efficiency.

Conclusion

Managing administrator paperwork across multiple states is indeed possible with the right tools, strategies, and knowledge. By leveraging technology, consulting experts, and adopting a unified approach, businesses and individuals can navigate the complex landscape of multi-state administrative requirements effectively. This not only ensures compliance but also saves time and reduces the stress associated with managing documentation across state lines. Through proactive planning and the use of tailored solutions, what once seemed like an insurmountable task can become a streamlined process.

Can I use the same forms across different states?

+

In some cases, forms can be similar, but always check each state’s regulations. Standardizing where possible can simplify the process, but you may need state-specific adaptations.

What are the risks of not managing paperwork correctly?

+

The risks include legal penalties, fines, loss of licenses, and even business interruptions. Non-compliance can damage your reputation and lead to operational challenges.

How often should I review my compliance strategy?

+

A yearly review is standard, but changes in state laws might necessitate more frequent adjustments. Keeping abreast of regulatory updates through newsletters or compliance software is also advisable.