5 Tips to Successfully Resubmit IDR Paperwork

When it comes to navigating the complex terrain of Income-Driven Repayment (IDR) plans, many student loan borrowers find themselves in a recurring cycle of resubmission. Whether due to incorrect information, missing documentation, or simply the passage of time, resubmitting IDR paperwork can be as stressful as it is necessary. However, with the right approach and understanding of the process, you can streamline your IDR resubmission and potentially secure a lower payment or even loan forgiveness.

Tips for Efficient IDR Resubmission

Here are five actionable tips to help you effectively resubmit your IDR paperwork:

- Stay Informed and Prepared: Knowledge is your best ally. IDR plans change, and so do the requirements. Ensure you are up to date with the current IDR plans like REPAYE, PAYE, IBR, and ICR. Regularly visit the Federal Student Aid (FSA) website or use their tools like the loan simulator to understand which plan benefits you the most.

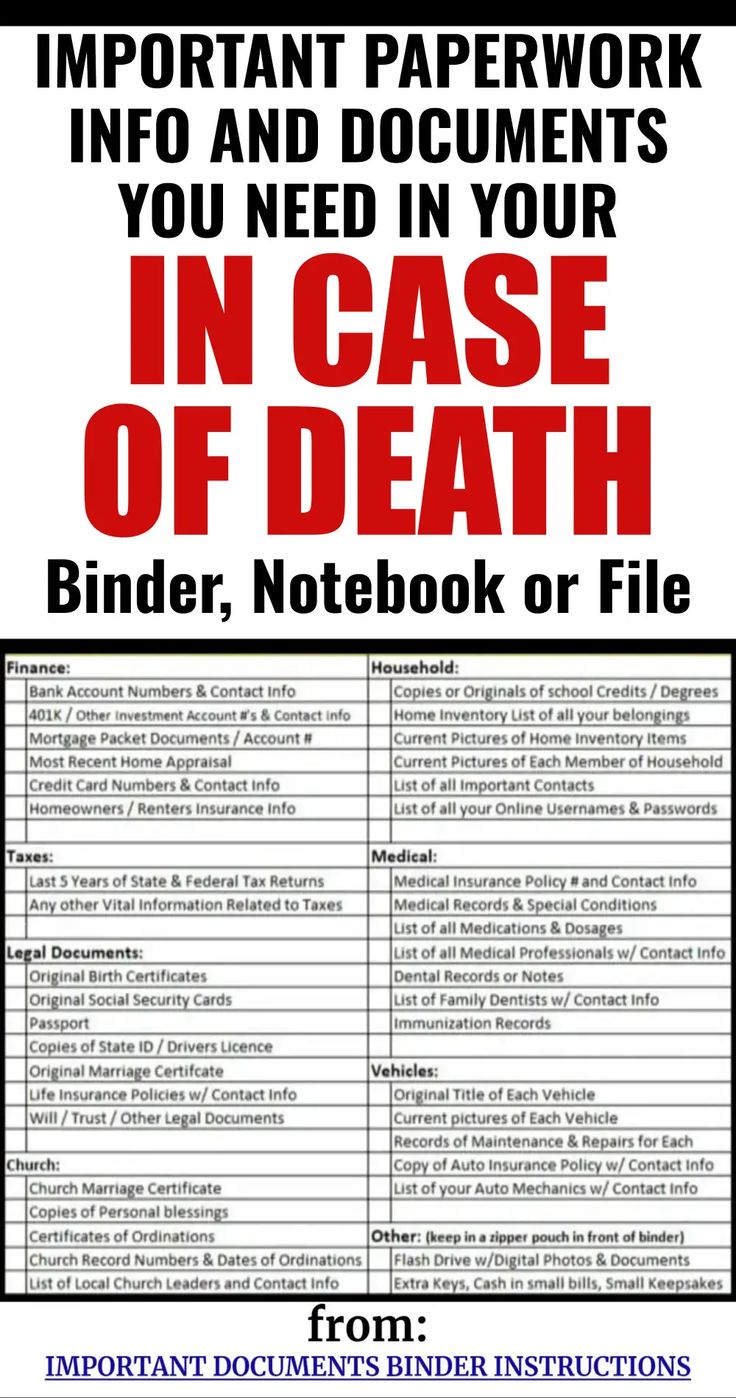

- Organize Your Documents: Keep your financial records in order. This includes:

- Tax returns

- Pay stubs

- Any additional income documentation required by your servicer

- A filled application or recertification form

- Understand the Deadlines:

- Annual recertification typically happens around the anniversary date of your IDR plan enrollment.

- Be aware of deadlines to avoid lapses in your income-based payment plan.

- Follow Up: After submitting your documents:

- Check the status of your application online or call your loan servicer.

- If delays occur, reach out to your servicer for updates and follow up to ensure your documents were received and processed.

- Seek Help: If you find the process overwhelming:

- Use student loan counseling services, either through your servicer or a third party.

- Consider hiring a financial advisor specializing in student loans if your situation is particularly complex.

Ensuring a Successful IDR Application

Here’s how you can ensure your application or recertification goes smoothly:

1. Accuracy is Key

When filling out the IDR forms, every detail counts. Any mistake can lead to delays or even rejections:

- Double-check all the information entered for accuracy.

- Ensure all signatures and dates are correctly placed.

- Verify that all required fields are completed before submission.

📝 Note: Even minor errors like misspelled names or transposed numbers can result in a denial.

2. Use Electronic Submission if Available

Many servicers now allow for electronic submission of documents:

- This method reduces the risk of lost documents.

- Use secure online portals or email if available.

- Save confirmation emails or numbers as proof of submission.

3. Understand the Importance of Timeliness

Timing can impact your IDR application:

- Submit your paperwork well before the due date to allow for any unforeseen delays.

- Set calendar reminders for when you need to recertify.

🗓️ Note: The Department of Education has a grace period, but submitting on time gives you peace of mind.

4. Monitor and Address Changes

Keep track of changes in your financial situation or family status:

- Inform your servicer if you get a new job, change your marital status, or have children.

- Changes can affect your IDR payment, potentially lowering it or qualifying you for loan forgiveness sooner.

5. Consolidation Considerations

If you have multiple loans:

- Consider consolidating if it would streamline your IDR application process.

- Understand that consolidation might reset the IDR forgiveness clock.

In summary, resubmitting IDR paperwork doesn't have to be a daunting task. By staying informed, being thorough, timely, and proactive, you can navigate the process smoothly. Remember, IDR plans are not static, so staying engaged with your servicer and your financial situation is crucial. This approach not only helps in resubmitting IDR paperwork efficiently but also in maximizing the benefits these plans offer, like lower monthly payments or eventual loan forgiveness.

What happens if I miss the IDR recertification deadline?

+

If you miss the IDR recertification deadline, your monthly payments will likely revert to the standard repayment plan amount, which could be significantly higher.

Can I apply for multiple IDR plans at once?

+

While you can explore different IDR plans, you can only be enrolled in one at a time. You can apply for the one that best fits your situation or switch plans when circumstances change.

How do I know which IDR plan is right for me?

+

Utilize tools like the FSA loan simulator to compare how different plans would affect your payments and time to forgiveness based on your income, debt, and other factors.