Bringing Cash to Closing: What You Need to Know

Introduction to Bringing Cash to Closing

Purchasing a home is a significant financial commitment, and one of the critical components of the home buying process is the closing. During this phase, buyers are often required to bring a substantial amount of cash to the table. But why is this, and what exactly does it entail? Understanding what to bring to closing is vital to ensure a smooth transaction. This post will guide you through the intricacies of bringing cash to closing, providing you with essential insights and practical tips to navigate this stage effectively.

The Purpose of Bringing Cash to Closing

Before delving into the specifics, it’s essential to grasp why cash is needed at closing. Here’s what you need to know:

- Down Payment: This is typically the largest portion of the cash required. While loans cover a significant part of the purchase, the down payment reduces the amount borrowed, potentially lowering interest rates and monthly payments.

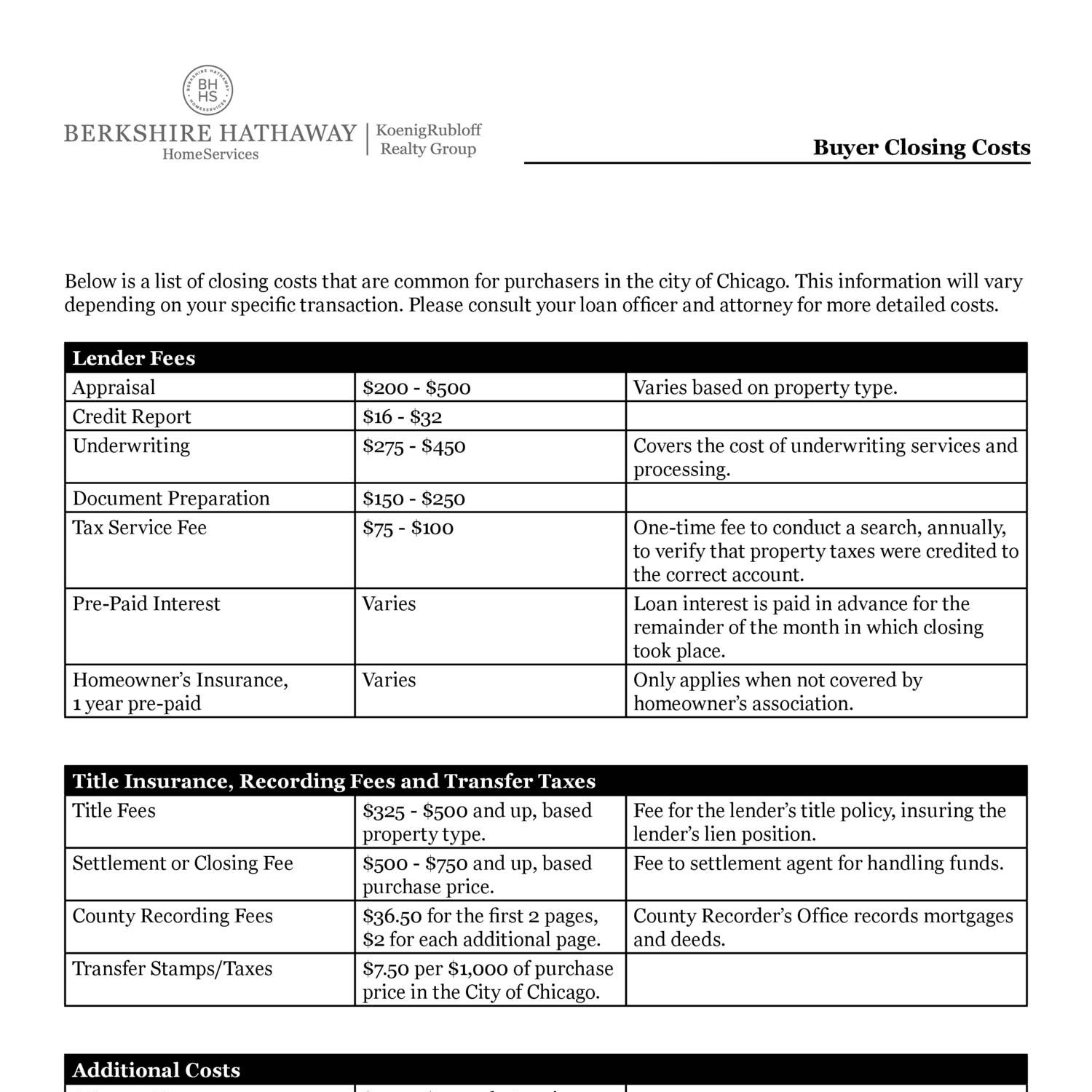

- Closing Costs: These are fees associated with the transaction, including appraisal fees, title insurance, escrow fees, and more. Typically, closing costs range from 2% to 5% of the home’s purchase price.

- Pre-paid Expenses: Often, buyers pay for items like property taxes, homeowner’s insurance, and interest in advance to establish escrow accounts.

How Much Cash Should You Bring?

Determining the exact amount of cash to bring to closing can be complex, as it depends on several factors:

- Loan Type: Different loans have different down payment requirements. For instance, FHA loans require a minimum of 3.5%, while conventional loans might require 20% to avoid PMI (Private Mortgage Insurance).

- Home Price: The cost of your home directly affects the down payment and closing costs.

- Location: Closing costs can vary significantly by region due to differing fee structures and local customs.

- Lender and Negotiated Fees: Your choice of lender and how you negotiate fees can impact the total amount you need to bring.

💡 Note: Don’t forget to request a Loan Estimate and Closing Disclosure from your lender. These documents provide detailed breakdowns of your expected costs and payments.

Calculating Your Cash Needed at Closing

| Item | Description | Typical Percentage of Purchase Price |

|---|---|---|

| Down Payment | The amount you pay upfront towards the purchase price of the home. | 3.5% - 20% |

| Closing Costs | Fees for various services rendered during the closing process. | 2% - 5% |

| Pre-paids & Escrows | Payments like taxes, insurance, and interest paid in advance. | 0.5% - 1.5% |

| Total Cash to Bring | Sum of all the above items. | Varies |

💡 Note: Use a mortgage calculator or consult with your lender for a precise estimate tailored to your situation.

What to Bring to the Closing Table

On the day of closing, you’ll need to bring several items:

- Cashier’s Check: Most transactions require funds in the form of a cashier’s check to ensure secure payment. Ensure this is for the exact amount required.

- Identification: Bring a valid photo ID like a driver’s license or passport.

- Home Insurance Binder: Proof of insurance is necessary for the lender to approve the loan.

- Settlement Statement: Review this document to confirm all figures.

Key Tips for a Smooth Closing

To ensure your closing day goes as smoothly as possible:

- Review Documents: Don’t overlook the importance of reviewing the loan estimate, closing disclosure, and other related documents ahead of time.

- Communicate: Keep open lines of communication with your lender, real estate agent, and the closing attorney.

- Ask Questions: If anything is unclear, ask. Clarifying uncertainties before closing can prevent last-minute issues.

In summary, bringing cash to closing is an essential step in the home buying journey. By understanding the components involved, calculating your costs, preparing necessary documentation, and ensuring smooth communication, you can make your closing experience as seamless as possible. Remember, this is not just about the money but also about ensuring that all legal and financial aspects of the purchase are correctly managed to secure your ownership of your new home.

Can I bring a personal check to closing?

+

No, you usually cannot bring a personal check. Cashier’s checks are preferred for the security they offer, ensuring the funds are immediately available and valid.

What if I can’t bring the exact amount of cash required?

+

If you are short on cash, discuss this with your lender as soon as possible. Options might include negotiating with the seller or obtaining a larger loan. However, bringing the exact amount is crucial to avoid delays.

Do I need to bring cash for closing if I’m getting a gift?

+

Yes, even if you’re receiving a gift for your down payment, you’ll still need to bring that amount in the form of a cashier’s check to the closing table, as funds must be properly documented and verified.