FMLA Paperwork: Do You Have to Pay Doctor Fees?

The Family and Medical Leave Act (FMLA) provides important job protection for employees who need time off for health-related issues or to care for a family member. However, the paperwork involved in applying for FMLA can be complex, and a common question arises: Do you have to pay for doctor fees? Let's delve into this topic to understand the financial aspects of FMLA certification.

What Is FMLA Certification?

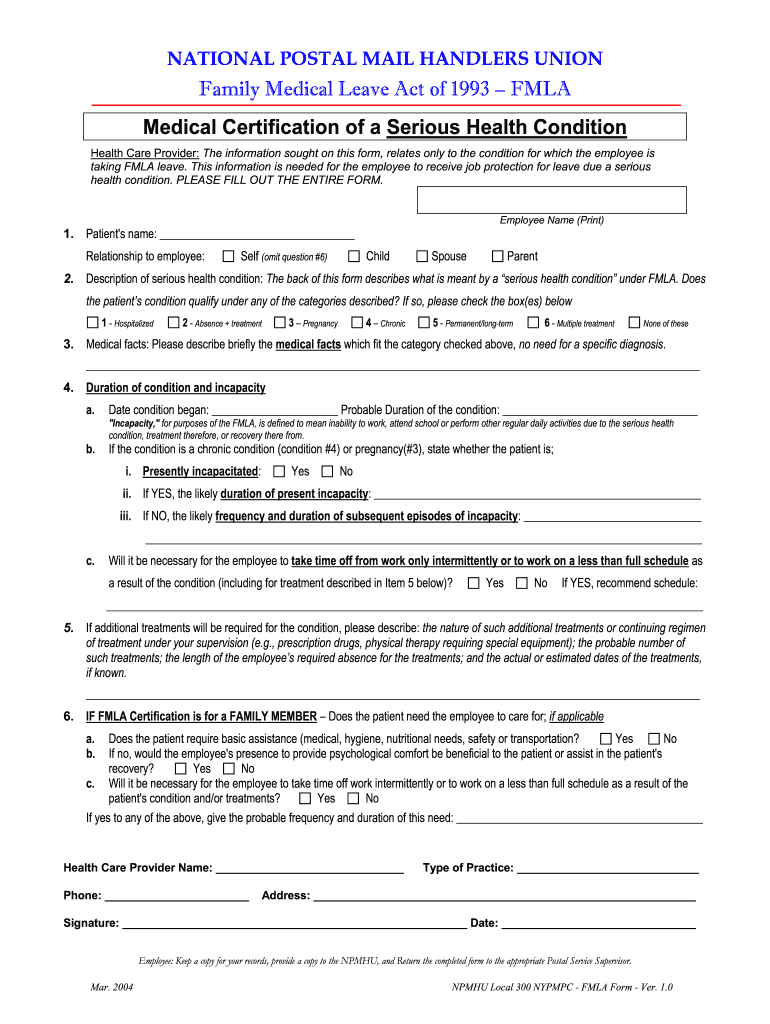

FMLA certification is a crucial step in proving your eligibility for FMLA leave. This certification generally requires:

- Medical diagnosis - A statement from a healthcare provider detailing your health condition or the condition of the family member you are looking after.

- Treatment plan - Information on the course of treatment and its probable duration.

- Duration of leave - An estimate of how long you might need to be on leave.

This certification ensures that the leave you’re requesting aligns with the qualifications set by the FMLA.

Do You Have to Pay for FMLA Certification?

Here’s where the question of doctor fees comes into play:

- Out-of-Pocket Costs: Typically, you might be responsible for any costs associated with the medical appointment required to certify your FMLA eligibility. This could include co-pays, deductibles, or fees if your provider charges for FMLA paperwork completion.

- Employer Responsibility: However, under certain circumstances, your employer might cover these costs:

- If your employer’s health plan covers this certification, you might not have any out-of-pocket expenses.

- Some employers might have a policy of reimbursing employees for certification-related expenses.

- Multiple Certifications: If your employer requests more than one certification during your leave, they must cover the costs beyond the initial one.

💡 Note: If your employer requires recertification during your leave, they are responsible for the costs of that recertification.

Factors Influencing Cost

Several factors can impact whether you’ll pay for FMLA certification:

| Factor | Description |

|---|---|

| Health Insurance Coverage | Your insurance might cover doctor visits required for FMLA certification. |

| Employer Policy | Some employers might have policies for reimbursement or coverage of FMLA certification fees. |

| Type of Provider | Fees can vary greatly depending on whether you see a general practitioner, specialist, or nurse practitioner. |

How to Minimize or Avoid Costs

Here are some strategies to manage or reduce the cost of FMLA certification:

- Use Insurance: Verify if your health insurance covers the doctor’s visit for certification purposes.

- Employer Policies: Check if your employer has any benefits or reimbursements for FMLA-related expenses.

- Documentation Submission: Provide any existing medical records or documents that could support your FMLA claim to lessen the need for new certification.

- Seek Alternatives: Explore options like using community health clinics or a healthcare provider who offers a free initial consultation.

Wrap-Up

In wrapping up our discussion on FMLA paperwork fees, remember that these costs are generally your responsibility, but there are ways to minimize or avoid them. Understanding your health insurance coverage, your employer’s policies, and alternative documentation options can significantly impact your out-of-pocket expenses. Always inquire with your HR department to explore available benefits or reimbursements that might ease the financial burden of FMLA certification.

Can my employer request a second or third opinion for my FMLA certification?

+

Yes, your employer has the right to request a second or third opinion, though they must cover the costs of these additional certifications if more than one is required.

What should I do if my insurance doesn’t cover FMLA certification?

+

Reach out to your employer to see if they have any reimbursement policies or consider using community health services or low-cost clinics to mitigate the costs.

Are there any tax deductions for out-of-pocket FMLA expenses?

+

While not directly for FMLA certification, you might be able to deduct some medical expenses on your tax return, subject to IRS regulations and limits.